|

||||||||||

| Home Nation World Business Opinion Lifestyle ChinAfrica Multimedia Columnists Documents Special Reports |

|

||||||||||

| Home Nation World Business Opinion Lifestyle ChinAfrica Multimedia Columnists Documents Special Reports |

| Business |

| New Bank on the Block |

| BRICS New Development Bank operates as a multilateral development financial institution to help emerging economies |

| By Hou Weili | VOL.9 September 2017 ·2017-09-05 |

The roofs at the Shanghai Lingang Industrial Area are now serving a more productive purpose than simply covering factories and warehouses. In August, the vast area in southeast Shanghai had solar panels installed on all roofs, capable of generating power for local businesses and surrounding households.

The inaugural project of the new energy demonstration program that is expected to be expanded to more areas was funded in 2016 by the first lending program of the New Development Bank (NDB), an international multilateral financial institution cofounded by BRICS countries.

"The rooftop photovoltaic power stations with a capacity of 100 kw will reduce annual carbon dioxide emissions by 88,360 tons," said Wang Tai, Deputy General Manager of Shanghai Hongbo New Energy Development Ltd., borrower of the NDB's first Chinese loan and contractor of the new energy utilization project.

This is just one of the sustainable development and green infrastructure programs funded and supported by the NDB. Since it came into operation in July 2015, the NDB has approved seven loans to member nations for green energy development. It is offering a developing country alternative to global development finance, according to observers.

Green focus

The green aspect is a big focus of the bank. According to Leslie Maasdorp, Vice President and Chief Financial Officer of NDB, 50 percent of its capital will be raised through issuing green bonds exclusively used for green projects. It is an effective way for financial institutions to support long-term energy-saving and environmentally-friendly projects with a low borrowing price, he noted.

To ensure raised funds be used for developing green industries and improving infrastructure, the NDB prioritized investment areas for each BRICS country. For China, urbanization is still a long-term and arduous task and should be advanced in a sustainable way. Green and low-carbon infrastructure projects are expected to be a priority. Zhou Xiaochuan, Governor of the People's Bank of China, the country's central bank, said earlier last year that China needed an annual investment of $600 billion in green sectors like environmental protection and restoration, renewable energy exploration and application, energy efficiency improvement and green transportation.

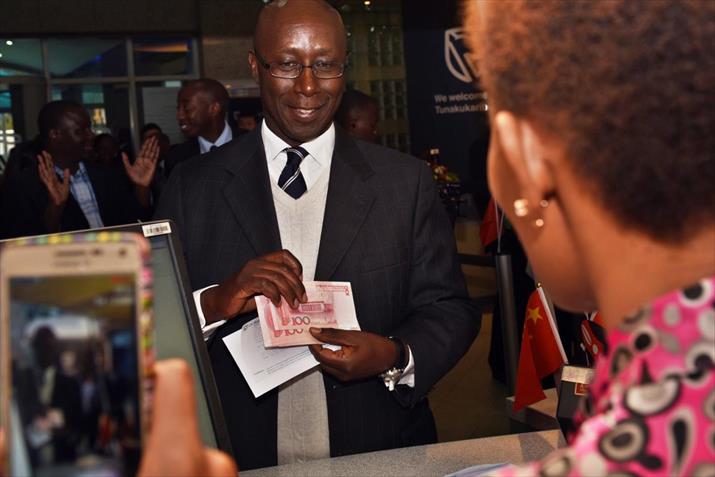

Supported by green bonds, South Africa puts green energy high up on its development agenda. Loans granted by the NDB in 2016 include one given to Eskom, South Africa's largest power supplier that generates nearly 95 percent of the electricity used in the country and 45 percent of that used in Africa. The $180-million loan will assist renewable energy projects and is expected to reduce carbon dioxide emissions by 2 million tons, according to the bank.

In fact, to optimize its power portfolio, South Africa introduced the Integrated Resource Plan in 2010 and pledged to add 10,000 mw of renewable energy capacity over the next 20 years. A major reduction, to around 46 percent of capacity by 2030, in reliance on coal as the main source of electricity will be realized due to the introduction of sustainable capacity from renewable sources.

"This financial institution cofounded by emerging economies aims to assist member countries to thrive in a sustainable path rather than achieve GDP growth at the cost of polluting the environment," said Zhan Shu, a senior advisor with the NDB.

Economic booster

Currently, China's economic slowdown and recession in other BRICS member countries may have cast doubts on the future of BRICS cooperation. But Maasdorp believes cooperation will not be jeopardized, but strengthened in the short term against the backdrop of a stagnant economy.

He said the bank had a long-term outlook and focused on supporting infrastructure projects that generate returns over long periods. "In the short term, the bank is a well-capitalized investor. Only by increasing investment in the infrastructure sector could the bank help economies in recession recover as soon as possible," he said.

For the convenience of South African projects, the NDB opened its African Regional Center in Johannesburg in 2016, which was officially launched in August 2017. "It will expand the bank's influence to a broader sphere in Africa," said Xu Xiujun, a researcher on the bank from the Institute of World Economics and Politics Studies with the Chinese Academy of Social Sciences.

More African countries are likely to be included in the NDB as it plans to invite new members in the near future. Although the continent has big challenges in terms of financing infrastructure, it also has vibrant emerging economies like Nigeria and Ethiopia. "With new members joining in, the bank will be more powerful and better play the role of a multilateral development financial institution," said Xu.

He also noted that it was imperative for the bank to obtain a high rating from international rating agencies and then raise local currency funding in member countries. "A high rating is the foundation for the NDB to lower financing costs and raise large amount of capitals," said Xu. Currently, the bank has received the highest ratings from Chinese rating agencies including Chengxin International Credit Rating and China Lianhe Credit Rating, but none from international agencies.

Facilitating renminbi internationalization

The NDB is the first international financial institution headquartered in China, but it doesn't mean it is Chinese-dominated, according to Maasdorp. "Shanghai is chosen because it is a major financial center and will attract global focus in financial terms," he said. In fact, the bank works on an equal-share voting basis with each of the five signatories contributing $10 billion to its $50-billion initial capital.

Fan Yongming, Director of the Center of BRICS Countries Studies of Fudan University, believes such an arrangement will give developing countries' a louder voice in international monetary and financial systems and bring in a diversified international monetary system.

"The establishment of the NDB will facilitate internationalization of China's renminbi by offering a platform for the currency circulation," said Fan. He explained that the NDB issues bonds in the international financial market besides absorbing deposits to raise funds. "With renminbi-dominated bonds being bought by global investors on a large scale, the process of currency internationalization is advanced," said Fan.

In the future, the NDB will also offer services as general commercial banks do, like trade settlement, besides supporting development projects with low interest rate loans. "Enlarging the share of renminbi in settling international trade transactions is also an important aspect of accelerating the process of its internationalization," said Fan.

He added that the NDB is not replacing current international or regional funding institutions but rather compliments them and helps push forward reforms of established international financial mechanisms. "The NDB and other institutions are more partners than competitors," he said. "It is such cooperation and competition that advances reforms on current mechanisms and brings emerging economies to the attention of established financial institutions."

| About Us | Contact Us | Advertise with Us | Subscribe |

| Copyright Beijing Review All rights reserved 京ICP备08005356号-5 京公网安备110102005860号 |