|

||||||||||

| Home Top News Economy/Tech Culture/Sports China in Foreign Eyes Green Development Videos Intangible Cultural Heritages |

|

||||||||||

| Home Top News Economy/Tech Culture/Sports China in Foreign Eyes Green Development Videos Intangible Cultural Heritages |

| ChinAfrica |

| Chain Effect |

| China–Africa Economic and Trade Expo in Changsha showcases new momentum in industrial cooperation |

| By Hu Fan | Web Exclusive ·2025-06-15 |

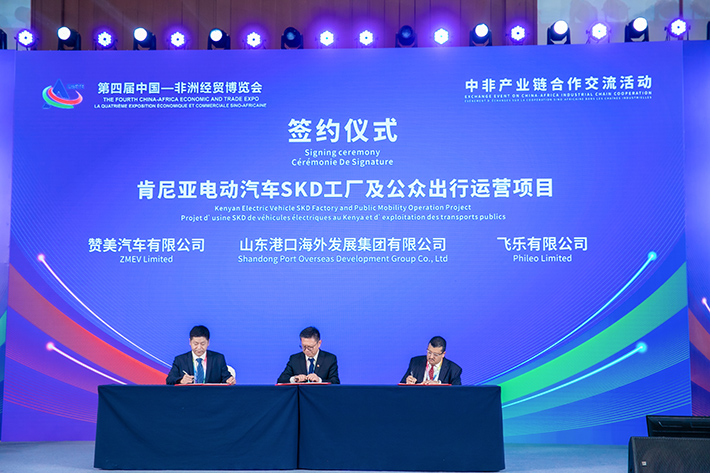

The signing ceremony for the Kenyan Electric Vehicle SKD Factory and Public Mobility Operation Project is held in Changsha, Hunan Province, on 12 June (Courtesy)

Machinery and related services took centre stage at the fourth China–Africa Economic and Trade Expo (CAETE), held in Changsha, Hunan Province, this June, amid a push to deepen industrial chain cooperation across key sectors like infrastructure, energy and agriculture. Inside the expo venue, industry leaders, officials and entrepreneurs engaged in intense discussions, and signed a series of agreements and memoranda which are set to spur a new momentum in China–Africa industrial collaboration.

A conference on 12 June dedicated to China–Africa industrial chain cooperation offered a glimpse of the growing network of partnerships driving this agenda. Discussions shed light on financial, legal and technological solutions needed to support these efforts, offering a window into where China–Africa industrial collaboration is headed.

Speakers highlighted how industrial chain development has become a cornerstone of mutually beneficial cooperation. For Chinese companies, it opens new avenues to invest and localise in Africa. For African nations, it offers a path to transform natural and demographic advantages into sustainable industrial and human capital gains, creating jobs and improving livelihoods.

Michelle Umurungi, chief investment officer of the Rwanda Development Board, underscored this point by referencing her country’s ambitious Vision 2050 plan. Rwanda aims to become a high-income country through industrialisation, digital innovation, green growth and regional value chain integration.

“But we recognised that this journey cannot be realised in isolation,” she said. “We see China not only as a key trading partner, but also a long-term partner in Rwanda’s industrial journey.”

SANY Group showcases a generator set at the fourth CAETE in Changsha, Hunan Province, on 12 June (Hu Fan)

Chinese FDI

Over the past five years, Chinese direct investment in Africa has averaged more than $3 billion annually, according to China’s Ministry of Commerce (MOFCOM), a sign of keen interest among Chinese firms to have a long-term presence on the continent. While investment in traditional sectors like infrastructure, agriculture and manufacturing continues apace, industrial chain cooperation is expanding rapidly into emerging fields such as the digital economy and green development.

In the digital space, Chinese companies have helped to build major data centres, launched cloud computing services and introduced 5G applications in fields ranging from mining to urban management. E-commerce is also flourishing, with platforms like Kilimall and Alibaba’s entrepreneurial training programmes helping African SMEs to connect to global markets.

Meanwhile, the green economy is gaining traction. China–Africa photovoltaic power projects now exceed 15,000 mw in installed capacity, providing clean energy to millions of homes, according to MOFCOM. Chinese automakers are also establishing electric vehicle production lines in countries like South Africa, Egypt and Morocco.

SANY Group, a major Chinese construction equipment manufacturer, is a case in point. Guo Ruiguang, chairman of SANY’s African business unit, recounted how the company evolved from a supplier of engineering machinery into a key player in Africa’s green energy landscape.

SANY’s machinery has been used in the construction of most of Africa’s major infrastructure projects, according to Guo. Yet, as early as 2015, the company began branching out, launching its first wind power project in Ethiopia, which has now become a major source of electricity for its capital. In 2024, SANY completed its first overseas wind-powered microgrid project, which started supplying electricity earlier this year.

“Our aim is to blend our low-carbon technologies and electrified equipment with Africa’s energy ambitions,” Guo said. SANY plans to invest 7 billion yuan ($970 million) in microgrid projects across Africa over the next three years, and will start local manufacturing of construction machinery in South Africa this October, according to him.

Ahunna Eziakonwa, UN assistant secretary general and director of the Regional Bureau for Africa at the United Nations Development Programme (UNDP), stressed the importance of a green industrial path to the sustainable growth of Africa, highlighting the role of green energy.

“Attracting investment into Africa’s green energy will contribute to meeting the increasing demand across the continent, while closing the access gap for over 500 million Africans who still do not have access to electricity,” she said.

The UNDP, she noted, is investing in Africa’s green industrial future, supporting biomass, solar and wind energy projects across the continent. Strengthening cooperation with China in these areas, she added, is a shared priority.

Kilimall displays its services at the fourth CAETE in Changsha, Hunan Province, on 12 June (Hu Fan)

Partnering for development

During the same session, the Export–Import Bank of China (CEXIM) and Bank of China unveiled a joint plan to support Chinese companies going global, including project financing, trade financing, and more advanced services such as mergers and acquisitions advisory and investment consulting.

Yang Dongning, vice president of CEXIM, said one of the plan’s key goals is to use flagship Chinese projects overseas as anchors to drive broader industrial chain coordination. By supporting upstream and downstream companies through industrial finance, the bank aims to boost the resilience and competitiveness of regional value chains.

With operations in over 160 countries, including 50 in Africa, the bank has become a financial backbone for China–Africa engagement. By the end of 2023, its outstanding foreign trade loans reached 3.14 trillion yuan ($437.23 billion), funding projects from landmark infrastructures to small-scale public service initiatives.

PowerChina, one of China’s earliest global engineering firms, is a prime example of this model in action. Its Deputy General Manager Ma Yuxin noted that the company’s success across more than 130 countries has long been enabled by the backing of Chinese financial institutions.

“We believe that Chinese companies going global shouldn’t do it alone,” he said. “Close collaboration between banks and enterprises - and among enterprises - is essential.”

Another player expanding China–Africa industrial linkages is Kilimall, a Chinese-backed e-commerce platform launched in Kenya in 2014. Now one of Africa’s leading online retail platforms, Kilimall has leveraged its local know-how to help Chinese companies to tap into African markets. Its services cover sectors from branding and marketing to e-commerce operations and financing.

Kilimall Vice President Chen Fuping is bullish about Africa’s industrial future. He sees strong fundamentals in abundant natural resources, low labour and land costs, and preferential zero-tariff treatment for non-resource goods entering China.

“China and Africa together represent a consumer base of over 2.7 billion people,” Chen said in a speech to the conference. “Many companies are already localising production to meet African demand - that’s how strong the market potential is.”

| About Us | Contact Us | Advertise with Us | Subscribe |

| Copyright Beijing Review All rights reserved 京ICP备08005356号-5 京公网安备110102005860号 |