|

||||||||||

| Home Nation World Business Opinion Lifestyle ChinAfrica Multimedia Columnists Documents Special Reports |

|

||||||||||

| Home Nation World Business Opinion Lifestyle ChinAfrica Multimedia Columnists Documents Special Reports |

| ChinAfrica |

| Banking and Beyond |

| Financial technology is changing the way banking works in Africa |

| By Kamailoudini Tagba | VOL.10 November ·2018-11-09 |

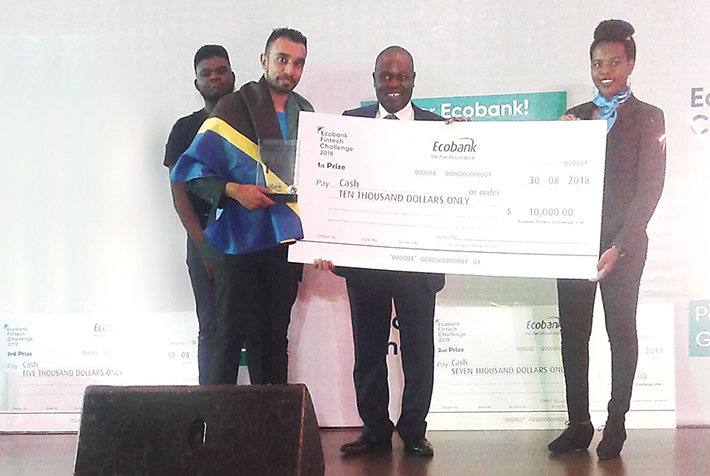

Nala CEO Benjamin Fernandes (second left) and Ecobank Group CEO Ade Ayeyemi (second right) at the Ecobank Fintech Challenge 2018 in Ecobank headquarters in Lome on August 30

Mobile phone penetration in Africa has considerably increased in recent years and is expected to soar even higher as Chinese brands Infinix, Huawei and Techno gain traction through quality and affordable prices.

The increase in the penetration coincides with a surge in the number of Internet users on the continent. Both these increasing trends make Africa one of the fastest growing global regions in terms of technology worldwide.

Smartphone digital content has become the order of the day as mobile technology enables companies to better serve their clients. Where this is having a drastic effect on changing customer service options and banking in general is financial technology, better known as fintech. As a growing sector, banking is witnessing a revolution as fintech startups around the world proliferate. Fintech companies have streamlined the banking sector, forever changing customers' relationships with these financial institutions.

Clients now have a wide range of methods to meet their banking needs. Strongly present in payment areas, technology companies also offer clients digital options like ATMs, online chat, mobile phone and Internet banking.

Rise of fintech

The rise of technology in the banking industry has reached epic proportions, with investment in fintech rocketing around the globe from $19.9 billion in 2014 to an unprecedented peak of about $41.7 billion in the first half of 2018, according to a July report by the UK-based firm Fintech Global.

In the process of changing the operation of banks, fintech companies have drawn the attention of venture capitalists, private equity firms, corporates and a number of other players.

One of these players is Pan-African bank Ecobank, the only African bank present in 36 countries on the continent. Ecobank has embraced fintech through its digital services as well as via its flagship program, the Ecobank Fintech Challenge launched in 2017.

"At Ecobank, we have always taken great pride in our commitment and leadership in financial technology. Our digital strategy is spectacularly successful and has changed the landscape of African banking," said Ade Ayeyemi, CEO of Ecobank Group. "As a technology-oriented Pan-African bank, we aim to be at the forefront of elevating Pan-African fintech companies through partnerships, collaboration and other forms of support."

The Ecobank Fintech Challenge works together with African and overseas fintech startups with businesses oriented toward the continent. The collaboration takes place in many ways, namely, service provider partnerships with local Ecobank country ecosystems for startups with extensive capabilities, multinational product roll-out opportunities for high-potential startups to launch products in Ecobank's markets across Africa and technical, networking and mentoring opportunities within Ecobank's global network.

Finalists of the challenge form the Ecobank Fintech Fellowship, which nurtures the most promising Africa-focused fintech startups.

The challenge offers opportunities for startups to contest in six areas, namely, Digital Onboarding/Account Opening/Know Your Customer (KYC), Remittances, Digital Sales or Marketing, Offline Mobile-to-Mobile Payments, Multi-Channel Corporate Payments and SME Intra-Africa Trade Platform.

With over 800 applicants last year, dominated by Nigeria winning the top three awards, the challenge this year attracted 412 applications.

Fintech Challenge 2018

Eleven finalists from countries such as Nigeria, Togo, Sierra Leone, Tanzania, South Africa and Kenya convened at the Innovation Fair and Awards on August 30, in Lome, Togo's capital, which is also the headquarters of Ecobank.

Nala, an offline mobile money application stood out as the best startup. Nala provides a unified user experience where multiple financial services are connected on one application, for which it was awarded the top prize of $10,000.

Since its inception four months ago, 15,430 Tanzanians have used the offline platform, said Nala CEO Benjamin Fernandes, who represented the startup at the finals.

Virtual Identity from South Africa was first runner-up. The startup creates a virtual video conferencing link between agent and customer. It is an easy-to-use web-based solution that allows a client to complete tedious KYC procedures from anywhere, making it convenient and a time saver. The Johannesburg-based firm took home $7,000.

Third-placed winner Wallet.ng is a startup from Nigeria that operates as a bank for a growing generation of smartphone users. The company gives people complete control over their financial future. It was born from the desire to build a bank that is as native to customers' devices as Facebook or WhatsApp. The fintech newcomer pocketed $5,000 in prize money.

Ayeyemi said Ecobank looked forward to working closely with all 11 fellows over the next year to "deliver innovative banking services at better price points that will improve the lives of Africans."

The 20 finalists last year received special training ranging from online branding to digital marketing.

"Through the Ecobank Fintech Fellowship, we were introduced to a dedicated online branding and marketing team that has helped us enhance our online presence. We are glad to have the opportunity to be part of this challenge," said Bade Adesemowo, CEO of Nigeria's startup, Social Lender which was crowned winner of the first challenge in 2017.

Ecobank China connection

Ecobank has, in its global expansion plan, positioned itself as the connecting bank between Africa and China, which is now by far the largest investor in the African economy - a reality proven again in early September with the 2018 Beijing Summit of the Forum on China-Africa Cooperation pledging to pump $60 billion into Africa's development.

With over a 100 Chinese corporates and financial institutions across its network, the Lome-incorporated financial institution has significantly contributed to the increase in trade and financial transactions between Chinese firms or investors and their African counterparts.

"On aggregate, we see transactional volumes of approximately $500 million per annum for our Chinese clients," said Amin Manekia, Ecobank's Group Executive of Corporate and Investment.

In 2012, Ecobank opened a representative office in Beijing, and to date has opened Chinese-speaking desks in several countries including Ghana, Kenya and Uganda.

The China desk in Ecobank Ghana, opened in 2011, has generated hundreds of millions of dollars worth of business between Ghana and China. One year after its setup, the transactional volume hit the $100 million mark, according to Ecobank.

In Kenya, a partnership between Ecobank and the Bank of China (BOC), dating back to early 2010, has given a boost to trade and to Kenya's imports from South Africa and China.

The China desks have been set up in conjunction with the BOC to provide a wide range of financial support services to African and Chinese businesspeople.

Transactional volumes through Ecobank for Chinese clients are expected to rise. Digital solutions proposed by fintech startups will increase international remittance from China to Africa. Chinese companies and investors can also make use of the solution to make international payments to their African partners located on the continent, or they can do inter-Africa payments to their clients by still using the fintech solutions.

"The way Chinese people can benefit from this is that [when] they are doing business in Africa, [they can] make payments to people easily [and] receive money from people they are doing business [with] in Africa [easily]," said Eddy Ogbodu, Ecobank's Group Executive of Operations and Technology.

(Reporting from Togo)

(Comments to niyanshuo@chinafrica.cn)

| About Us | Contact Us | Advertise with Us | Subscribe |

| Copyright Beijing Review All rights reserved 京ICP备08005356号-5 京公网安备110102005860号 |