|

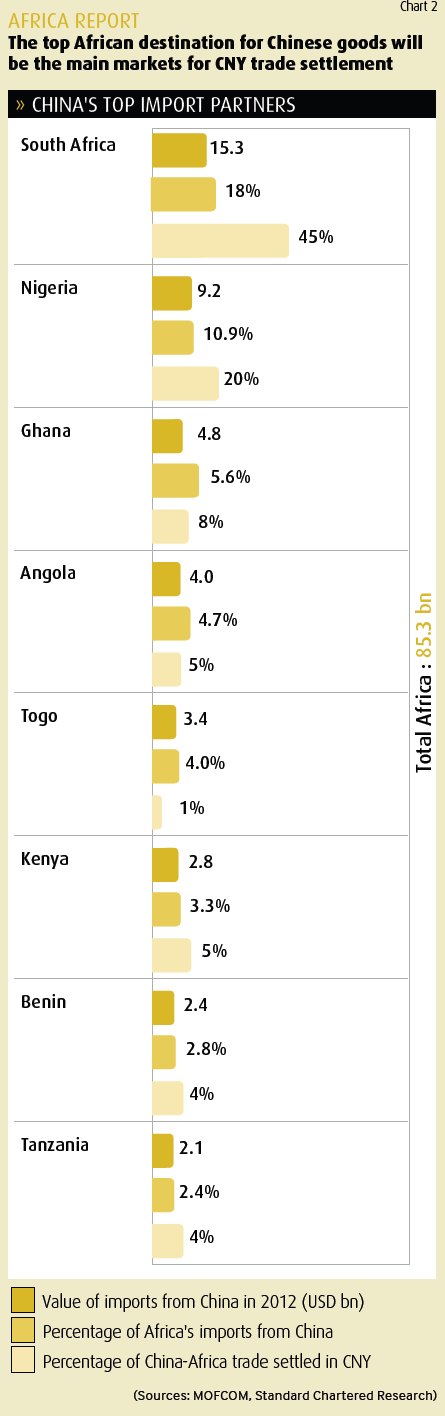

According to Standard Chartered, the geographical scope of the use of the yuan in Africa is expanding gradually. Data on the value of yuan payments between Africa and China and Chinese Hong Kong, released by the Society for Worldwide Interbank Financial Telecommunication (SWIFT) in January 2013, shows that yuan-denominated SWIFT payments were made between China and 18 African countries. In 2012, this number stood at 16 countries, up from just five in 2010. South Africa, with the region's most developed financial markets and a strong presence of Chinese banks, is likely to be the main market for yuan trade settlement, accounting for around 45 percent in the longer term. Other top importers of Chinese goods, such as Nigeria and Ghana, are likely to account for a further 20 percent and 8 percent, respectively (see chart 2).

Dim sum bonds

As the use of the yuan as a trade-settlement currency becomes more widespread, more African central banks are likely to look to diversify their foreign exchange reserves to include the yuan.

Nigeria said in 2011 that it would start to hold yuan in its central bank reserves, and Standard Chartered analysts said that Nigeria and Tanzania's central banks each bought 500 million yuan ($79.37 million) worth of dim sum bonds from China Development Bank, which launched 3.5 billion yuan ($555.5 million) in dim sum bonds last July, and issued the bonds in Hong Kong.

Angola has also invested in dim sum bonds, while Kenya and Ghana have shown an interest in holding yuan in their reserves. But South Africa leads the continent's financial rush to use the yuan. The country's central bank will be able to invest up to $1.5 billion in dim sum bonds, following an announcement at the BRICS Summit in Durban in March this year. China is South Africa's biggest buyer of raw materials and its largest trading partner, purchasing 13 percent of the country's exports.

Back in 2012, Li Dongrong, Vice Governor of the People's Bank of China, the country's central bank, optimistically suggested that, in five years, 20 percent of African central banks' foreign reserve portfolios would be in yuan.

The offering of yuan-denominated debt, first by South Africa and potentially Nigeria, and then other higher-rated African sovereign states, could be the next development in the yuan market in Africa, according to Standard Chartered. Appetite for bonds issued by smaller, less-liquid African economies is likely to be lower.

"For African issuers looking to finance capital expenditure plans, issuing bonds denominated in yuan provides access to a new investor base, enables the expansion of existing financing channels, and offers a lower cost of financing than do bonds from other international capital markets," said Baynton-Glen.

(Source: International Business Times)

|