|

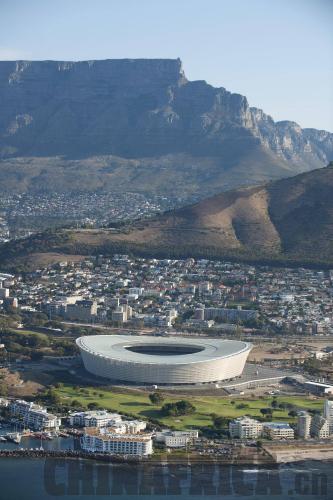

Cape Town iconic Table Mountain is South Africa’s premier tourist attraction

2014 marks the celebration of South Africa year in China, bringing with it the opportunity to examine the relationship's economic impact and how this can evolve going forward. Since establishing diplomatic ties with the People's Republic of China (PRC) a decade and a half ago, South Africa has been well-served by this relationship mostly through high global commodities prices, largely driven by Chinese demand. This has generated export earnings, employment opportunities and made the country a more attractive destination for global investment (prior to 2012).

Growing at an average of 30 percent per annum, merchandise trade between South Africa and China since 1998 increased more than 40-fold to reach about $60 billion in 2012. South Africa is China's largest trade partner in Africa despite not being an oil producer. Conversely, China became South Africa's largest trade partner by the end of 2009.

South Africa has also been among the top countries for Chinese outbound foreign direct investment (FDI) in Africa. Companies such as Sinosteel and Hisense had already entered South Africa prior to 1998. Huawei has made great inroads into South Africa and the region. The investment of the Industrial and Commercial Bank of China into Standard Bank, and Star TV's purchase of Top TV are just some of the deals that bolstered Chinese FDI to South Africa. These span from financial services, mining, electronics and technology to autos, wine, property development and renewable energy.

South African firms have also taken advantage of opportunities in China. At the forefront of this have been large companies such as SABMiller, Naspers, Bidvest, Sasol and Discovery to name a few. Naspers and SABMiller's investments are paying off. Their revenue growth is largely fuelled by their Chinese operations in light of expanding purchasing power in China.

Increasing commercial ties have gone handin- hand with greater tourism. More than 132,000 Chinese tourists traveled to South Africa in 2012, up 50 percent from 2011 and a threefold increase from 2009, making it the largest tourism destination in Sub-Saharan Africa for Chinese tourists. With China the fastest growing source of outbound travelers in the world, and South Africa's fourth largest source market, this sector is poised for further natural growth potential as economic relations magnify.

While the springboard that South Africa can be for Chinese companies looking at the region is well defined, strategies to showcase the opportunities that the Chinese market from an export and investment perspective holds for South African companies and the added value of South African companies to the Chinese market need to be further expanded upon.

In recent months, activities commemorating 15 years of diplomatic ties have included South African companies attending three expos in Beijing, Shanghai and Xiamen to showcase their products, services and expertise as part of the Department of Trade & Industry's efforts to promote various sectors into China. But particular attempts to diversify South Africa's narrow export profile to China have been gradual at best. Although bilateral trade has rapidly expanded, the structure of South Africa's exports has not.

In addition, while export diversification is being promoted, import competition has been met by a protectionist stance in South Africa. This has included the organized manufacturing sector pouring cold water over a proposed free trade agreement with China, as well as the 2007-08 quotas that were imposed on clothing and textile imports from China, seen to be eroding the lesser competitive but labor-intensive South African industry.

It is time for a maneuvering shift of South Africa's direction in its China engagement - one that is more favorable for South Africa. With high-level political exchanges and good relations between both sides, and a bilateral partnership that has been "upgraded" over the years from "partnership" to "comprehensive strategic partnership," this relationship should bear greater fruits for South Africa, particularly with mounting pressures to address the socio-economic ills of the country. This will require a more creative and agile China engagement strategy.

Part of this engagement strategy will need to include integrating highly competitive sectors where South Africa has a comparative advantage into China's growing middle class. The financial services sector is one industry where China has begun to take steps toward greater liberalization, and where "SA Inc." should position itself more aggressively.

On the tradable goods side, economic forces underway in China - namely rising wages that place increasing competitive pressures on the low-end manufacturing segment, and mounting domestic demand as living standards improve - will provide opportunities for value-added sectors outside China as price advantages erode, supporting the off-shoring of mature industries.

South Africa should make a concerted effort to secure a portion of these opportunities in order to remake its trade and investment relationship with China. Integrating into global as well as regional value chains, receiving higher exports earnings, creating employment opportunities and producing more value-added activities should be key to this strategy.

Part of the solution will need to be a more collaborative approach between South Africa's public and private sectors in order to contest with emerging competition in this space from other African and Asian countries that are agile and capable of pursuing similar approaches. South Africa will need to look at how to creatively leverage its comprehensive strategic partnership going forward, by creating an enabling and competitive business environment for local and foreign companies alike to take advantage of these opportunities.

(The author is Director at Frontier Advisory, a South African research, strategy and investment advisory company)

|