|

|

|

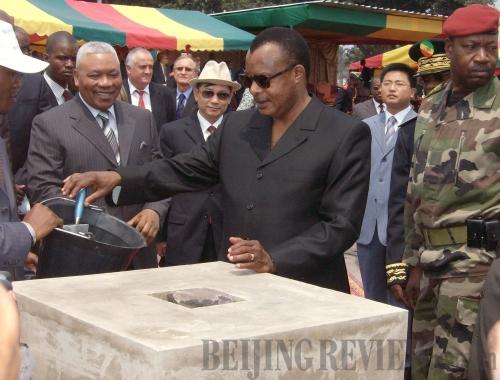

FOUNDATIONS: Rep of Congo President Nguesso at a Chinese funded airport venture ceremony (XINHUA) |

Chinese ECAs in Africa

China-Africa trade has shot up from just $10 billion per annum in 2000 to a peak of over $100 billion in 2008, almost matching U.S. trade with Africa, which peaked in the same year at $130 billion. The important difference is that China has doubled its exports to Africa between 2005 and 2009, from $20 billion to $40 billion. Over the same period, U.S. exports to Africa have moved from just $12 billion to $18 billion. But to what extent have China's ECAs been pivotal in opening Africa to Chinese firms?

According to Li Ruogu, President of the China EXIM, EXIM has invested one-third of its $139 billion assets in Africa.

On the other hand, Sinosure's liabilities are only 20 percent in Africa - yet by total number of projects, Africa dominates with 84 percent out of Sinosure's annual global cover of over $140 billion for 2010. Compare this to U.S. EXIM, no minnow, authorizing $21 billion of loans guarantees and insurance globally in 2009 but having supported just $3.8 billion in transactions with Africa since 1999.

Far from promoting exports to Africa, particularly large infrastructure projects or capital goods exports, OECD ECAs are not even providing long-term cover, so firms have little chance of competing with Chinese businesses. For example, U.S. EXIM does not offer long-term (7 years plus) cover in 27 African states.

America's loss?

There is a lack of support from OECD ECAs relative to Chinese ECAs in Africa, but what is it that Western firms are losing out on? Sinosure is insuring large numbers of relatively smaller projects compared to its global operations, but contrary to the Western experience of trading with China, this is not evidence of the flooding of local markets with underpriced Chinese manufactures. A UK government study has found that it is only in Uganda that basic consumer goods equaled a fifth or more of goods imported from China. Across the continent these consumer goods imports are displacing imports from elsewhere, and not supplementing them to the detriment of local production.

According to Standard & Poor's research, China EXIM gave 90 percent of its loans in 2006 to state-owned enterprises or large projects in foreign countries. China EXIM puts the figure in Africa for 2006 at 79 percent to large infrastructure projects across 36 countries.

So would the U.S. still lose out to the Chinese even if cover were offered? Probably, but not because of any Chinese advantage in public financing. Rather, it is because, as Witney Schneidman, a top Africa advisor to Obama, has noted, "U.S. companies don't build roads, don't build dams, don't do energy infrastructure," but "U.S. companies are well represented" in the extractive sectors in a number of countries in Africa where it is competitive. Awareness of these facts rather than scaremongering about China enacting a new colonial era has important ramifications for China and the U.S. and their dealings in Africa.

Finally, there exists a great potential for collaboration in ECA activity. No ECA can be expected to prioritize "development" of another country over its national interest, but there is potential for the ECA activity to "complement not compete" toward achieving Africa's developmental goals. For example, the U.S. and Europe's high-tech agricultural solutions can be complemented by Chinese roads, ports and power to give a real kick-start to pro-poor growth. However, nothing is certain, as no ECA has given an indication of how they will respond to the rise of the Chinese ECAs and their businesses reaching into Africa, but as an area with the potential for conflict or progress, it is certainly an area to keep an eye on. |