|

New investment

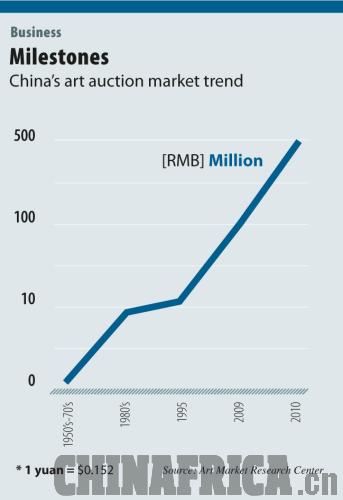

However, Xi emphasized that China's art auction market has come to a historical turning point, where the collection of art matters far more than personal enjoyment.

"Artworks in the transaction have gradually turned into financial resources and monetary assets," Xi explained.

He added that the latest global financial crisis accelerated the turning process. During the crisis, Chinese investors were facing an unstable stock market performance and a domestic housing market that was under policy adjustment. By contrast, the country's art market kept a strong momentum in growth, leading to start investing in art.

Take the result of a contemporary Chinese painting at auction as an example. In November 2010, The Long March, a painting by the modern Chinese painter Li Keran, was sold at 107.5 million yuan ($16.36 million) at Guadian Auction, the largest auction house in China. The price created a new record for artworks of this kind.

"People can find history in contemporary art just as in ancient art. Moreover, at any time, the reserving high quality artworks are rare, and that's why the market also confirms the high value of The Long March," Jia Shikun, 55, a Beijing collector, told ChinAfrica.

Although some experts have shown concern over the bubbles that might be created by the super rapid expansion of the art auction market, Xi projected an optimistic future.

"On one hand, the consumption idea has developed a lot in China. That means there will be more demand on high-grade cultural consumption. On the other hand, the current excess liquidity and inflation pressure will certainly lead more investors into the relatively high-return market," Xi added.

The "China's Art Market 2010" forecasted that the country's art auction market will see a transaction volume of 70 billion yuan ($10.65 billion) in 2011 and the total market scale will reach 360 billion yuan ($54.79 billion).

|