|

Dim trade outlook

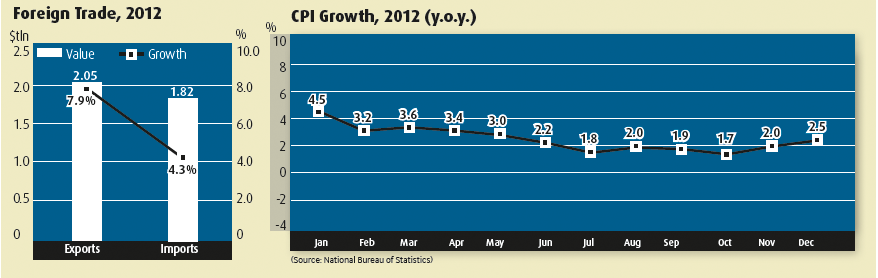

China's exports and imports totaled $3.87 trillion in 2012, up 6.2 percent, according to the General Administration of Customs (GAC).

The growth rate slowed sharply from the 22.5-percent rise registered in 2011 and also missed the government's 10-percent target set for 2012.

"Although this number missed the government's target, China's foreign trade performance still tops the world and is the best among all economies in the world," said Zheng Yuesheng, Spokesman of the GAC.

The slowdown of foreign trade growth is a result of sluggish external demand, rising production costs at home and increasing trade protectionism in other countries, Zheng said.

Four years after the onset of the global financial crisis, the world economy remains fragile and growth in high-income countries is weak, says the World Bank in the newly released Global Economic Prospects report.

"The economic recovery remains fragile and uncertain, clouding the prospect for rapid improvement and a return to more robust economic growth," said World Bank Group President Jim Yong Kim.

The demographic dividends and the gains of China's entry into the WTO have been watered down, said Liu Ligang, an economist at ANZ National Bank Ltd. In the long run, foreign trade will no longer pump as much steam into the country's economic growth as it used to.

"Among the world's major economies, Chinese exports were the most targeted by trade protectionism. Emerging economies are also increasingly launching trade investigations against China, while the number of targeted industries is rising," said Zheng. Chinese exporters were targeted by 72 trade investigations in 2012.

Risks ahead

Inflation, which used to be an acute headache for the Chinese economy, was within government control in 2012. However, long-term inflationary pressure still exists. Monetary policies must be rolled out with full caution to avert the re-ignition of a price spiral.

The consumer price index (CPI), a main gauge of inflation, rose 2.6 percent in 2012, well below the government's annual target of 4 percent, said the NBS.

Wang Jun, an expert with the China Center for International Economic Exchanges, said that China will face greater inflationary pressure in 2013 than in 2012.

"Inflation is likely to rise in the coming months as a result of rising food prices and higher labor and land costs, the quantitative easing measures in foreign countries and stabilizing domestic economic growth," Wang told Xinhua News Agency. He predicts the CPI will stay at 3-4 percent in 2013.CA |