Think of Zambia and what it produces and chances are, the first thought that comes to mind is the country's rich copper mining industry. However, in terms of contribution to GDP, the nation's agricultural sector is more important than its relatively mature mining sector and presents attractive investment opportunities.

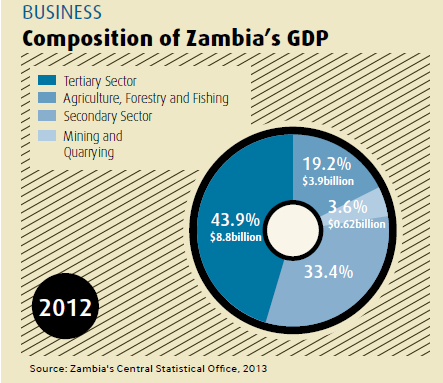

In 2012, the primary agricultural, forestry and fishery sector contributed 18.2 percent to Zambia's GDP, while the food, beverage and tobacco sector contributed an additional 5.3 percent to GDP (captured in the manufacturing sector). In the same period, mining only contributed 2.1 percent to Zambia's economy. The agricultural sector is also a key employer in the country, providing more than 65 percent of all jobs, and has the potential to make a major contribution to poverty reduction.

Farm blocks

In order to diversify its economy and reduce over-reliance on export of mining products, which account for approximately three quarters of the country's export earnings, the Zambian Government is making concerted efforts to promote investment in the agricultural sector. Cash crops such as cotton, coffee, tobacco, sugarcane, pineapple, cashew nuts, mango, citrus fruits and horticultural/floricultural crops have been identified as key priority crops. These crops also show great potential for further investment as well as the diversification and expansion of Zambia's agricultural sector and its export composition. The biofuels sector presents further potential, given the country's reliance on costly fuel imports.

In recent years, Zambia's food exports to neighboring countries such as the Democratic Republic of the Congo (DRC) and Zimbabwe have increased rapidly. In 2011, for instance, food exports to the DRC surpassed the $135 million mark – up from $42 million in 2005, reflecting the importance of Zambia as a regional food exporter. The development of the agricultural sector in countries such as Zambia, which is among the top four countries in Africa in terms of available cropland, will play a fundamental role in ensuring food security in the Southern African Development Community (SADC) region and in reducing the continent's annual food import bill of close to $4 billion.

With the intension of attracting investment in the farming sector, the government has earmarked agricultural sites for the development of so-called farm blocks. Each of these farm blocks will have at least one core farm of 10,000 hectares and a number of commercial farms of between 1,000 hectares and 3,000 hectares. By providing key infrastructure such as trunk roads, bridges, electricity, dams, schools and health centers, the government is aiming to create a supportive and attractive environment for farming investment.

In addition to the production of agricultural commodities, the agro-processing industry presents investors with attractive investment opportunities. The example of Zambeef Products PLC, a diversified agro-processing company that grew in less than 20 years into a major agricultural conglomerate, with annual revenues exceeding $120 million, showcases the potential of the agro-processing industry. Zambeef Products PLC exports its products to regional markets such as Angola, Botswana, the DRC, Malawi, Namibia, South Africa, Tanzania, Zimbabwe, and further abroad to China, England, India and Italy.

Another success story in Zambia's agricultural sector is Zambia Sugar, one of the largest agricultural employers in Zambia. In 2007, South Africa's Illovo Sugar, which holds an 82 percent stake in Zambia Sugar, invested $200 million in the Nakambala Expansion Project to more than double the company's production capacity. This investment also turned Zambia into the second largest sugar producer within the Illovo Group.

Agricultural opportunities in Zambia have not gone unnoticed by international investors. In early 2012, for instance, JSE-listed Zeder Investments acquired a 96 percent stake in Chayton Africa, a Zambian agricultural operation, for $38.2 million. Saudi investment company Manafea Holdings announced in 2011 a $125 million investment to a pineapple project in Zambia. In September 2012, Singaporean Olam International Ltd. acquired Zambia's largest coffee estate, Northern Coffee Corporation Ltd. for $6.15 million and committed to investing further $40 million to fully develop a 2,000 hectare Arabica coffee plantation in the next five years.

Land-locked to land-linked

In order to unlock its economic potential, Zambia requires significant investment in the construction and maintenance of key infrastructure. Most of the country's existing infrastructure is outdated and insufficient to accommodate the requirements of its growing economy. For instance, only 9,403 km of Zambia's 40,265 km of core road networks are tarred. Due to insufficient investments and maintenance of the national rail network, average locomotive speeds have dropped significantly to an average of 15 km/h.

In order to address the issue of inadequate road transport infrastructure and to turn Zambia from a land-locked into a land-linked economy, President Michael Sata launched the Link Zambia 8,000 Program in September 2012. This five-year road rehabilitation and upgrading project is expected to cost more than $5 billion. It is planned that 8,200 km of roads will be tarred during the project period. In the 2013 budget, approximately $825 million has been allocated to transport infrastructure developments and upgrades.

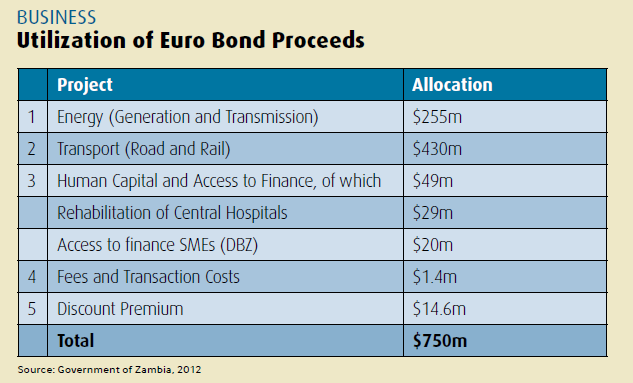

In September 2012, Zambia issued its inaugural Euro bond. International investors placed about $12 billion in orders for Zambia's maiden dollar-denominated bond, allowing it to increase the size of the issue from the proposed $500 million to $750 million, while lowering the cost to just 5.63 percent – lower than the equivalent borrowing cost of Spain at the time of the bond issuing. The oversubscription of the bond reflects the confidence international investors have in the Zambian economy. The government intends to use $685 million (>90 percent) of the proceeds from the bond issuance for infrastructure developments.

Energy potential

In addition to transport infrastructure, energy infrastructure remains insufficient and negatively impacts the expansion of economic activities. Being endowed with large hydropower potential, Zambia could emerge as a key energy supplier for the region. The example of the Copperbelt Energy Corp. (CEC) reveals the potential of private sector involvement in the energy sector. Founded in 1997 and listed on the Lusaka Stock Exchange in 2008, the CEC has grown into a major player in Zambia's energy sector and provides half of the electricity consumed in Zambia. In March 2012, the CEC signed a Memorandum of Understanding with the Nigeria-based Africa Finance Corp. with the aim to develop energy assets in Africa, reflecting CEC's ambitions to further extend its footprint on the continent.

Zambia's proximity to a number of fast-growing economies, such as Angola, the DRC and Tanzania, makes it well positioned to serve as a platform to access these markets. Given the government's determination to diversify the economy and to upgrade the country's infrastructure to facilitate and accommodate economic growth as well as trade, Zambia presents a range of attractive opportunities and investment incentives for international investors that are interested in exploring opportunities beyond the mining sector. CA

(Simon Schaefer is senior analyst at Frontier Advisory)