|

Review of China's Economic Performance in the First Quarter of 2010

In Q1 2010 China's economy delivered a stellar performance with GDP growth reaching well into double digits again. Yet areas of concern are possible signs of a bubble in the housing market and questions on the health of China's banks. With tighter monetary policy now seemingly imminent, moreover, 2010 may yet become more complicated, as Premier Wen predicted in March.

China's gross domestic product (GDP) grew by 11.9 percent in Q1 2010 (see Chart 1), outstripping the 8.7 percent annual GDP growth achieved in 2009 and the 10.7 percent of Q4 2009. Chinese Premier Wen Jiabao stated in March that he expected 2010 to be a very difficult year for the economy. The data for Q1 should, however, inspire quiet confidence among Chinese leaders, especially as China is this year expected to contribute a full third of global growth and is set to overtake Japan as the world's second-largest economy.

The 11.9 percent growth rate for Q1 2010 is impressive, yet the figure is measured against the time when China's economy was at its crisis-induced nadir in Q1 2009. In March, however,

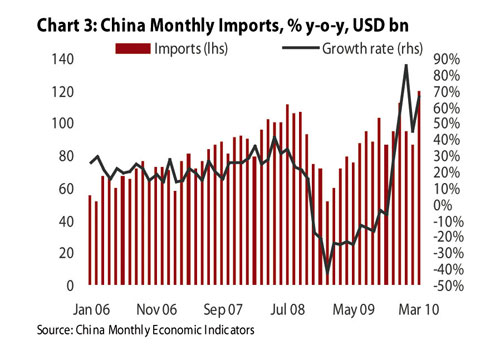

China registered a $7.2 billion trade deficit, its first since 2004. China's trade surplus for the quarter decreased by 76.7 percent year on year, yet government officials characterized March's deficit as a temporary blip. China's exports gained 24 percent year on year in March, following a 46 percent increase in February (see Chart 2). Imports leapt by 66 percent in March, after a rise of 45 percent in February (see Chart 3). The rise in imports followed a near quadrupling of vehicle imports in March, as well as increases in raw material prices as net imports of crude oil reached the second-highest level on record while iron ore imports in Q1 reached record levels.

Consumer prices increased 2.4 percent in March year on year, lower than the 16-month high of 2.7 percent in February. Industrial output increased 18.1 percent year on year in March, down from 20.7 percent in the first two months of the year. Along with China's fast-growing exports, consumption has continued to expand with retail sales growing by 18 percent year on year in Q1 and by 21.5 percent year on year in March (see Chart 4).

Lingering concerns

Government attempts to curb excessive lending growth resulted in Chinese banks issuing only 510.7 billion yuan ($74.8 billion) in new loans in March. The figure was substantially lower than the 700.1 billion yuan ($102.5 billion) in loans extended in February, and the total amount for Q1 this year (2.6 trillion yuan) was well in arrears of the 4.6 trillion yuan extended in the same period in 2009, yet still constituted 35 percent of the government's full-year lending target of 7.5 trillion yuan. Yet the president of the Industrial and Commercial Bank of China (ICBC) in April stated that China's four largest publicly traded banks - ICBC, China Construction Bank (CCB), Bank of China (BOC), and Bank of Communications (BoCom) - still require 480 billion yuan to be able to comply with regulatory requirements. This figure is more than four times the amount that ICBC, BOC and BoCom plan to raise this year.

Record growth in property prices in March increased fears of a bubble forming in China's housing market. Residential and commercial real estate prices in 70 cities rose 11.7 percent year on year, and investment in real estate during Q1 increased by 35 percent to 659.4 billion yuan ($96.5 billion). In the first two months of the year the government raised mortgage rates and re-imposed a sales tax, and in March it was announced that developers will have to pay a higher deposit for land purchases. The rapid rise in house prices will add further impetus not only to impose new property taxes but also to increase interest rates, especially if rising home values push April's consumer price index past 3 percent.

Quiet confidence

Despite these concerns, Q1 2010 was another impressive milestone on China's road of recovery from the global financial crisis. Robust growth at home, moreover, has been complemented by less strident relations with China's major trading partners, notably the United States, on issues such as the value of China's currency. As China prepares for another year in which its economic value to the rest of the world will be immense and obvious for all to see, China's leaders have every reason to be quietly confident. Yet Q1 2010 is also likely to have been the last quarter before the implementation of tighter monetary policy. All the factors now point in this direction due to the need to limit inflation and a housing market bubble and to prevent overheating. Indeed, the last quarter may have been the culmination of China's recovery with the realization that its time to move on.

|