|

More of the Same – Overheating, Bubbles and Balancing the Two

Rapid growth, the threat of bubbles and the need to balance the two – this could be a simplified assessment of the state of China's economy in May 2010. This has been a recurring set of circumstances in China ever since it returned to 8 percent-plus growth in Q3 2009. Yet fast growth and the threat of asset price bubbles have continuously fueled speculation by economists on the sustainability of China's growth trajectory.

Susceptible to bubbles

Estimates of overheating and bubbles in China have been mostly a shouting match between vociferous bearslike hedge fund managers Jim Chanos ("China is Dubai times a thousand or more") or James Richards ("China is in the midst of the greatest bubble in history") and the rest of us who do not quite see China's fast-growing economy in terms of such extremes. Yet as we go further into 2010, as the pace of China's economy keeps intensifying and the housing market keeps inflating, the balancing act becomes progressively harder to maintain. Or so, at least, it would appear – China has more or less been doing this for decades.

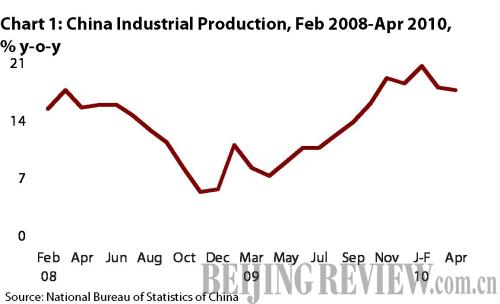

The numbers for April continued to inspire China's ongoing boom and threatening bubble story. Industrial production and fixed-asset investment both decreased slightly in April from a month earlier yet still grew strongly on a year-on-year basis, with industrial production increasing 17.8 percent year-on-year (see Chart 1) and urban fixed-asset investment increasing 25.6 percent year-on-year to reach $684.4 billion (see Chart 2). China's purchasing managers remained busy in April, the index gauging their activity - China's PMI - rising slightly from the month prior to 55.7 in April.

This strong display in the PMI is a direct result of another indicator of China's economic boom - massive consumer spending. Retail sales increased 18.5 percent year-on-year in April (see Chart 3), and symbolic of China's possible overindulgence, 40 luxury vehicles sold for a staggering $22 million at the Beijing Auto Show, some paid for with cash. Then there is the lurking threat of inflation. Both consumer and producer prices were up in April, increasing 2.8 percent and 6.8 percent year-on-year, respectively. The jump in the consumer price index (see Chart 4), the highest in the last 18 months, suggests that a further tightening of the Chinese Government's "moderately-loose" monetary and fiscal stance are becoming increasingly necessary to curb this trend.

China's external economic matters also conveyed both a sense of optimism and cause for concern. On one hand, international trade increased dramatically. Exports jumped 30.5 percent year-on-year while imports surged 49.7 percent year-on-year during April. In contrast to March's trade deficit, April saw $119.9 billion sent abroad as exports, which was $1.68 billion in excess of imports of $118.2 billion. It seems clear that China's manufacturing is now again operating at high intensity after the slowdown of this year's Chinese New Year holiday. Despite these positive signs, the recent fiscal troubles within the European Union have spread to the world's financial markets, including China's. Chinese stocks began to falter toward the end of April, causing the Shanghai Composite Index to fall 0.7 percent for the month. This downward trend in stock prices has continued through the beginning of May.

Most of those seeing a bubble in China are pointing at the housing market, however. The ongoing debate over the existence or not of a bubble within this sector intensified as data released in May showed a record breaking 12.8 percent increase in housing prices for the month of April, a continuation of a drastic upward trend that has persisted for the last 11 months. Measures implemented to halt this seemingly unsustainable trend have been largely ineffective thus far. Banks have curbed lending, the government has established a lower lending quota for the year and raised the required reserve rate for Chinese banks.

Beijing has suspended the issue of sales permits for high-end properties, although by reducing the supply available to the market in this way, it may have inadvertently put further upward pressure on prices. A 1.5 percent property tax now also seems imminent in Shanghai, and more government efforts will be forthcoming. Certainly, given all the attention afforded to China's housing sector recently by the public, housing industry leaders and the government, the issue seems unlikely to end lightly. The real question for China's economy will be not just by how much growth in the housing market will slow within the year - as government efforts seem intent on achieving this - but what will be the overall effect on China's economy? Will a constrained real estate market impede the overall growth of China's manufacturing and export-oriented economy? The bears think so, yet they – like the rest of us – can just guess.

|