|

|

|

China Econometer |

|

|

China Econometer |

|

|

China Econometer |

|

|

China Econometer |

Solid, Overheating or Slowing Down? Gauging the Trajectory of China's Economy in May

The threat of inflation and a bubble in the housing market have in May raised familiar fears of overheating in China. The central bank is still not convinced of the rigidity of China's economic recovery, and decreased industrial production in May has inspired speculation that China may actually be on the verge of another slowdown. Is China's economy thus on a solid footing, overheating or slowing down?

Overheating or still not solid?

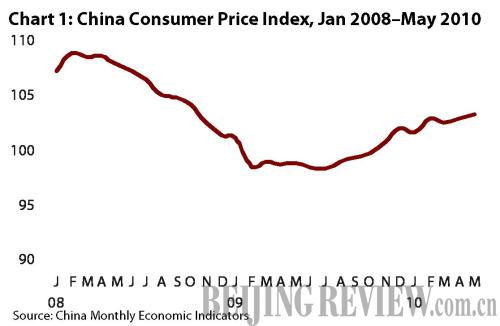

In May, the Consumer Price Index (See Chart 1) in China crept over 3 percent for the first time since October 2008. Three percent is the inflation target set by China's government for the year, and with prices now exceeding this target the pressure points of inflation and overheating are evidently becoming more acute.

Yet government attempts to rein in the housing market bore some fruit in May when house prices contracted in first-tier Chinese cities and sales decreased by about 25 percent. At -0.4 percent, the contraction in house prices was a minimal decrease, however, from the record house price increases registered in April and will not do much to allay fears of a bubble forming in China's housing market. Hence as has now become the norm, May saw further claims of asset bubbles in China.

Nouriel Roubini, the New York University professor who predicted the financial crisis before global markets peaked, is the latest to state as much when he said in May that China's economy may be overheating. Economic growth could slow to 7-8 percent in 2011, according to Roubini, and the greatest challenge for China is to boost domestic demand in order to sustain an economic expansion that has mostly been based on investments and exports.

In a statement issued on June 8, China's central bank also expressed its reservations on the rigidity of domestic demand when it described China's recovery as still not being on a solid footing. Yet a number of indicators for May seem rather to only reinforce the idea that China's recovery is more solid than not. Retail sales where robust growth persisted throughout May (See Chart 2) with an increase of 18.7 percent (up from 18.5 percent in April), and imports and exports both surged by nearly 50 percent in May.

Slowing down?

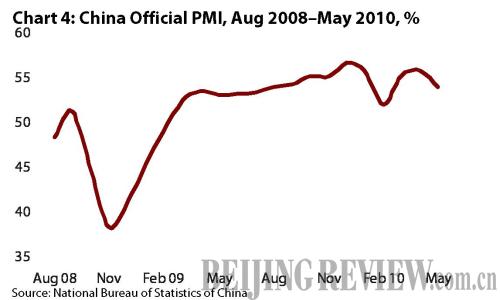

China's industrial production in May (See Chart 3) contracted, however, decreasing to 16.5 percent (from 17.8 percent in April). The Purchasing Managers Index (See Chart 4) also fell in May to 53.9 percent (from 55.7 percent in April). Some economists have described the decreases in these industrial indicators in May as signs of an early slowdown in China, which is being exacerbated by weaker growth in the Euro Area and by government attempts to curb excessive growth in China's housing market.

All this may even mean that the government may not raise benchmark interest rates after all (despite the threat of rising inflation) or allow the Chinese currency to appreciate (despite strong urging from China's major trade partners to do so).

With robust retail sales growth and only slightly slower manufacturing production growth, the state of China's economy in May is thus far from unsound if not in fact quite stable. Rising inflation and still rapid growth in China's housing market have raised the spectre of overheating, yet could the decreased manufacturing production in May be indicative of a new slowdown in China's economy? The numbers allow endless speculation, yet only time will tell.

|