|

|

|

China Econometer |

|

|

China Econometer |

|

|

China Econometer |

|

|

China Econometer |

A Glorified Downturn

Q2 2010 seems to have been a difficult one for China. Industrial production decreased while prices kept rising, forming the backdrop to slower economic growth. Yet these are the makings of a well-executed plan to rein in the property market and cool the economy, and although there are apparently concerns in China's banking system, slightly less growth is nothing if not a blessing in disguise.

Down but not out

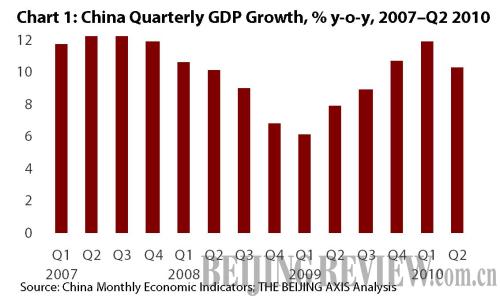

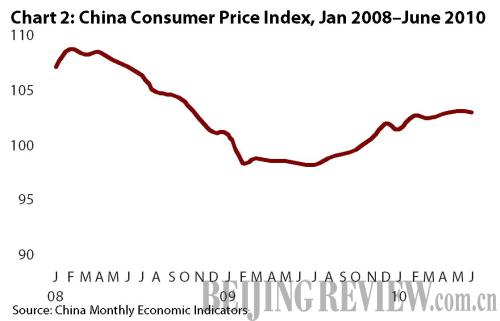

The numbers for China's economy in the second quarter of 2010 were clearly down. Economic growth slowed to 10.3 percent for Q2, down from 11.9 percent in Q1 (see Chart 1), and growth for the first half of the year came to 11.1 percent. Prices in June maintained a steady upward curve, with the Consumer Price Index (CPI) rising by 2.9 percent (after rising 3.1 percent in May, see Chart 2), while the Producer Price Index (PPI, measuring producer prices for manufactured goods) rose by 6.4 percent. For the first half of the year, CPI was up 2.6 percent and PPI, 6 percent.

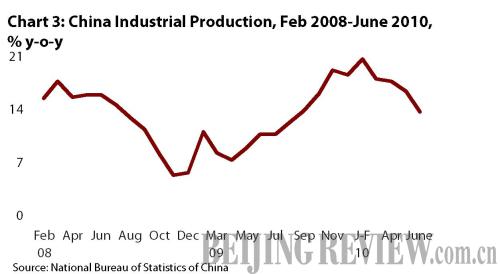

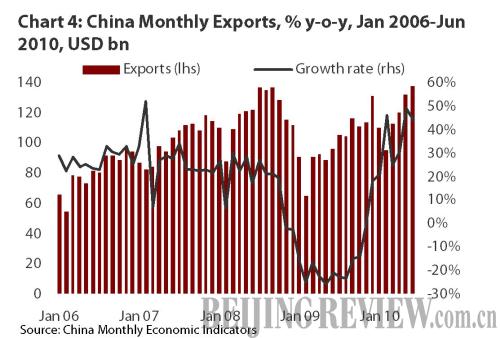

Yet while prices kept rising, China's industrial production slowed all the way down to 13.7 percent, the slowest pace since August 2009 (see Chart 3). The drop in industrial production was further reflected in decreased power usage in China during June amid weaker demand from heavy industries. Indeed, China's power consumption rose 14 percent in June to about 352 billion kwh, the slowest pace since February. The slowdown may well have been worse but for China's exports, which enjoyed a surge of 43.9 percent in June (see Chart 4), while imports increased by 34.1 percent. These trade figures resulted in China's largest monthly trade surplus this year so far of about $20 billion.

Self-inflicted remedies

The picture at the end of June thus seemed to underline Premier Wen Jiabao's recent sober assessment of China's economy as "good but vulnerable." China's situation was good, he said, because the stimulus had done such a good job, but the domestic and international economic environment, he added, remained very complicated. Yet in fact the slower growth in Q2 was to a much greater extent the result of the government's attempts to put the brakes on credit expansion, investment spending and property speculation. For all these indicators – and the threats of asset bubbles and overheating so frequently associated with them – Q2 was a godsend. M2, the broadest measure of money supply, grew 18.5 percent in June, down from 21 percent in May, and in the first half of 2010 new loans in China fell by about 37 percent to 4.63 trillion yuan ($683.9 billion). Even China's bubble-maligned property market – where property prices reached record increases of 12.8 percent in April this year – ended a 15-month streak of price increases in June.

Plan comes together

So despite most economic indicators in China trending downwards in June, nobody is too displeased. The People's Bank of China has stated that money and loan growth in the first half of 2010 was reasonable and that liquidity in the banking system was appropriate. This echoes Premier Wen's statements in July that despite the challenges still confronting China's economy, the government has no plans for any major economic policy changes.

Indeed, there is clearly no need for major changes: threats of overheating and asset bubbles have for the time being receded, and economic growth is still well into double figures with the International Monetary Fund recently increasing its 2010 GDP forecast for China – which is expected to contribute no less than a full third of global economic growth this year – from 10 percent to 10.5 percent.

Below the radar, however, there are a few new threats that may be lurking. China's National Audit Office recently reported to the legislature that mounting debt incurred by local governments could be undermining economic recovery in certain areas, as many projects were being financed through quasi-independent companies created to circumvent restrictions on lending to local governments.

In addition, Fitch, the credit ratings agency, in mid-July released a report claiming that Chinese banks were increasingly engaging in complex deals that did not fully disclose the size and nature of their lending operations. The report also claimed that loan growth in the first half of the year could have been understated by as much as 28 percent, or $190 billion. The Chinese Government seems well aware of these concerns, however, and whatever the extent of the risk facing China's banks, the response from Beijing will be swift (if required) or gradual and measured, but come it will.

|