|

INFLATIONARY HEAT IN WINTER CHILL

Inflation has emerged in full force to menace China's economy. The highest inflation in 28 months – this sober reality in essence sums up how much the heat has been turned up on China's economy as the cold winter descends over Beijing. While the temperature drops, food prices have been rising rapidly as the Consumer Price Index hit 5.1 percent in November (up from 4.4 percent in October), driven by an 11.7 percent increase in food prices. From January to November, the inflation rate reached 3.2 percent, surpassing the annual government target of 3 percent for 2010.

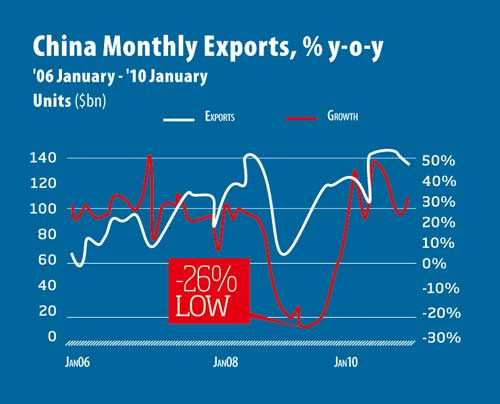

These higher than expected inflation figures have further raised expectations that an increase in interest rates is imminent.The last increase was prompted by unexpectedly strong trade data for November, which showed China's exports rising by 34.9 percent year on year to $153.3 billion. China's exports to other developing economies were especially strong, notably to Russia (increasing 72.7 percent year on year), and to South Africa (increasing 48 percent year on year). China's imports were dominated by raw materials such as oil and iron ore, reflected in the high growth of imports from major mining countries like Australia (increasing 55.4percent year on year) and South Africa (increasing 64.1 percent year on year). China's trade surplus expanded to $22.9 billion in November, an increase of 15 percent from October.

Becoming prudent

Ever since China unveiled a large stimulus package in November 2008, followed by a record lending spree in 2009 and a 27.7 percent expansion in M2 – the broadest measure of money supply – the supposedly excess liquidity in the Chinese economy has often been regarded as a prime driver of asset bubbles. All this accompanied China's "moderately loose" monetary policy. Yet the dramatic rise in inflation has clearly contributed to a reassessment of this monetary stance. An annual Central Economic Work Conference of the Chinese Government, held in mid-December, declared its intention of shifting the "moderately loose" monetary policy back to a "prudent" one in 2011 (as was in place from 1998 to 2007), a rather vague policy description leaving much room for manoeuvring. It now appears that the annual bank lending target for 2011 has been set at around 7 trillion yuan ($1,054.2 billion), higher than expected and only slightly less than the 7.5 trillion yuan ($1,129.5 billion) target set for 2010.

Food price check

Right now, however, as an indication of the overheating of the economy, rising inflation is reducing the value of workers' earnings and making daily necessities more expensive, especially for lower-income households who spend proportionally more of their income on food. In October, for example, while CPI increased by 4.4 percent, the price of fresh vegetables increased by a full 31 percent, and some vegetable prices have soared by as much as 60 percent in 2010.

Given the urgency of responding to rapid food price increases, the government has indicated its willingness to use a number of short-term measures such as reducing toll fees for trucks transporting fresh vegetables, increasing the supply of oil and grain from government reserves, lowering charges for stalls, providing temporary subsidies for low-income households, and even implementing price controls, if necessary. With the Chinese Spring Festival approaching next month in in February, it appeared that the government had resorted to temporarily applying price caps on cooking oil in December, the price of which had jumped by 13 percent in October. The last time price caps were applied in China was in January 2008, when the measures were extended to pork, cooking oil, eggs, flour and liquefied petroleum gas, among other products. As was the case in 2008, the successful impact of a price ceiling on cooking oil is far from certain and may even result in shortages as producers cut production in light of lower prices. A shortage of cooking oil during the country's major holiday period would prove to be disastrous.

Whatever the impact of these measures may turn out to be, China's National Development and Reform Commission expects consumer prices in China to remain high throughout the first quarter of 2011, at least.

|