|

China's Housing Market

China's red-hot property market presents one of the most formidable challenges to China's government. Rapid and sustained housing price increases have caused many observers to see an asset bubble in the offing, yet government attempts to temper price increases met with some success in 2010, although 2011 may yet see the implementation of a property tax.

The existence or not of a housing bubble in China is a vexing billion dollar question facing the world's most dynamic economy today. The question essentially is whether house prices in China are too high and have been rising too fast for too long. Participating in a very vibrant real estate market in rapidly developing urban centers, first-time house buyers in China currently are likely to uniformly answer this question in the affirmative.

Yet housing prices in China may in fact not be over-valued at all. This is the conclusion presented in a working paper released by the International Monetary Fund (IMF) in December 2010. But, the authors add, some of the biggest cities like Shanghai and Shenzhen may be in the early stages of excessive price growth. Moreover, a range of policy measures implemented by the Chinese Government in 2010 to cool the market does seem to have had the desired effect. It is difficult to dismiss the threat entirely as there are certain cities where regulations have been less effective, but the obvious conclusion is that, while China's housing market is indeed growing at dangerously high levels, the regulators are generally able to keep the situation in hand.

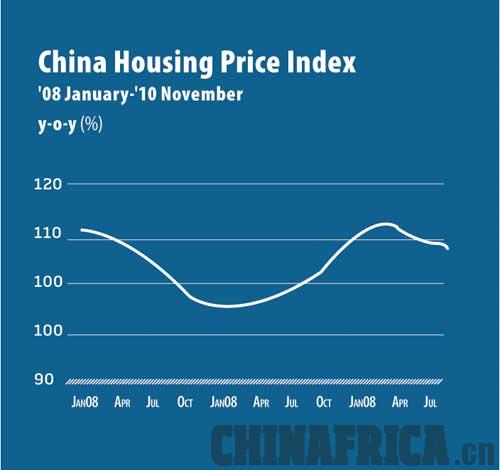

The month of April 2010 appeared to have been somewhat of a watermark in China's frothy housing market. Following about a year of a continuous trend of drastically increasing housing prices, April saw a record-breaking surge of 12.8 percent year on year in housing prices, which inspired vociferous talk of the size (as opposed to the existence of) China's property bubble. Yet if you look at the trend of housing prices over 2010 in Chart 1, it is clear that something changed after rip-roaring April – price increases started precipitously trending downward. After falling for six consecutive months, house price increases in November fell further to 7.7 percent year on year. This extended dip in house prices is the intended result of concerted measures implemented by China's government regulators to cool the market. These measures included such policy instruments as higher down payment requirements for first and second home purchases, prohibiting mortgage applications for third homes. The broader impact of such tightening measures on China's economy is further evident in China's Purchasing Manager's Index (PMI) decreasing from 55.2 percent in November to 54.9 per cent in December (see Chart 2).

|