|

GAUGING SEASONAL FACTORS

China's first quarterly trade deficit in seven years occurred in the first quarter of 2011. This development has been ascribed to seasonal factors, namely inflation and strong growth in China; the Spring Festival holiday in February during which China's exporters closed shop; and rapidly increasing commodity prices. The holiday period is now over, yet how will these seasonal factors continue to impact China's economy?

For the first time since 2004, in the first quarter of 2011 China registered a small quarterly trade deficit of just more than $1 billion. Announcing the data in early April, China's General Administration of Customs ascribed the deficit in part to surging international commodity prices, the rapid growth of China's domestic economy and rising inflation, and seasonal production slumps during China's Spring Festival, which took place in February. China's imports in March rose to a record high of $152.05 billion, up 27.3 percent year on year, with exports just ahead at $152.2 billion - up 35.8 percent year on year, but not enough to close the quarter's deficit.

So if we are then currently under the sway of such potent seasonal factors, how lasting and significant will their impact on China's economy be?

Economic growth and inflation

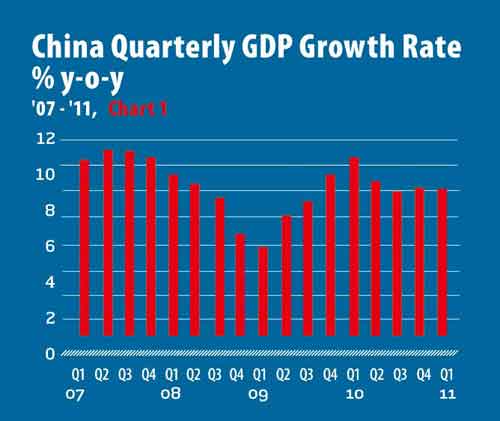

China's economy registered a rampant 9.7 percent year-on-year GDP growth in the first quarter of 2011, only slightly down from 9.8 percent in the fourth quarter of 2010 (see Chart 1). This is still far in excess of the targeted 7 percent growth rate set out in the 12th Five-Year Plan (2011-15). Of much greater concern than high growth, however, are high prices. Inflation continues to cast a pall over China's economy: the Consumer Price Index (CPI) in March climbed to 5.4 percent (a 32-month high), up from 4.9 percent in February (see Chart 2), so that the figure for the first quarter came to 5 percent. In the first week of April, China's central bank raised interest rates by 25 basis points in an attempt to put a lid on inflation. This was the fourth time since October last year that interest rates have been increased, and China's largest banks have been required to hold back a record high 20 percent of their deposits as reserves. Yet many economists believe that China's central bank is nearing the end of its tightening cycle, and officials in China are apparently confident that inflation will start to wane in the second half of the year. If China's economy continues to run at near double digit growth, monetary tightening may yet remain in vogue.

There are signs of a slowdown in a few markets in China, and much of this is attributable to the impact of the current high rate of inflation. According to the China Association of Automobile Manufacturers, auto output and sales grew by only 5.34 and 5.36 percent year on year, respectively, in March, down 52 and 50 percentage points from a year earlier. The industry has clearly suffered from the abolition of supportive policies and rising oil costs, as well as new regulations to control congestion in China's cities. Consumer confidence surveys in China from late 2010 have indicated, moreover, that urban consumer confidence is at a low ebb, again reflecting the impact of rising inflation.

China's industrial value-added output grew 14.4 percent year on year in the first quarter, an increase from the 14.1 percent of the January-February period (these two months are traditionally grouped together to account for the annual holiday period). The Purchasing Managers Index (PMI), moreover, rose to 53.4 percent after three consecutive months of decline (see Chart 3).

In April 2011, the five heads of state of Brazil, Russia, India, China and South Africa attending the BRICS summit on Hainan Island in China collectively voiced concern on excessively volatile commodity prices. In March, China's imports of the main commodities like copper, iron ore and soy beans all rebounded strongly from the holiday month of February. Data released by China's Customs indicated that China's unwrought copper and semi-finished copper, for example, rose by 29 percent to reach 304,299 tons. Iron ore imports increased 22 percent, and imports of soy grew by 51 percent. With recent upheavals in the Middle East, the outlook for commodity prices in the near term remains volatile.

|