|

CHINA-AFRICA TRADE IN THE AUTOMOTIVE SECTOR

As China's economy has grown, so too has its position in the international automotive sector: It now ranks first in terms of production and sales. This rising industry within China is becoming increasingly connected with Africa through trade and investment, as African economic growth expands its market potential.

On the road to prosperity

As China's economy has grown, its citizens have become more affluent. One of the most visible signs of this rising prosperity is the proliferation of motor vehicles on Chinese streets, corresponding to China's newfound position as the world's largest consumer of automobiles. Due to the expanding domestic market, most Chinese auto manufacturers have concentrated a majority of their efforts at home. This may be changing however, as Africa's rising affluence has caught the attention of Chinese carmakers for its market potential.

China has exported over 100,000 vehicles each year to Africa since 2006 - a relatively small figure in comparison to the world-leading 18.6 million China produced in 2010. Nonetheless, Chinese vehicles are the fifth most imported into Africa, valued at $1.3 billion in 2009 or 7.5 percent of the African import market. Rounding out the top five are Japan ($2.8 billion), South Korea ($2.4 billion), Germany ($1.9 billion) and the United States ($1.7 billion).

China's carmakers maintain their market share in Africa by taking a holistic approach to the continent. In the last decade, 47 African countries were recipients of Chinese automobiles, the largest importers evolving from Sudan in 2000, to Libya in 2002, to South Africa, and then to Algeria - the largest in 2008 and 2009.

In addition to exporting vehicles to Africa, some Chinese producers are attempting to further solidify their position in the market through direct investment. Gonow has been one of the most ambitious in its expansion in Africa, currently with the capacity for 10,000 SUVs and 10,000 minibuses at a plant in Egypt. In 2010 it announced plans for a $10-million South African factory, to be operational by 2013. The potential of the African market to import, and increasingly produce its own vehicles through foreign investment is testament to its economic potential; the road toward Africa's modernization may yet be one traversed by Chinese automobiles.

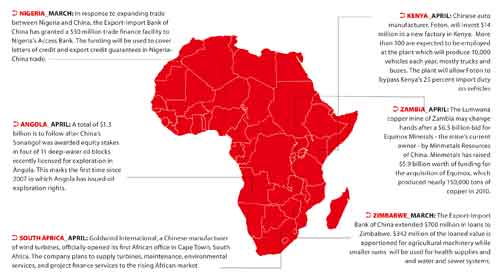

➲ Nigeria_MARCH: In response to expanding trade between Nigeria and China, the Export-Import Bank of China has granted a $30 million trade finance facility to Nigeria's Access Bank. The funding will be used to cover letters of credit and export credit guarantees in Nigeria-China trade.

➲ ANGOLA_APRIL: A total of $1.3 billion is to follow after China's Sonangol was awarded equity stakes in four of 11 deep-water oil blocks recently licensed for exploration in Angola. This marks the first time since 2007 in which Angola has issued oil exploration rights.

➲ SOUTH AFRICA_APRIL: Goldwind International, a Chinese manufacturer of wind turbines, officially opened its first African office in Cape Town, South Africa. The company plans to supply turbines, maintenance, environmental services, and project finance services to the rising African market.

➲ Kenya_APRIL: Chinese auto manufacturer, Foton, will invest $14 million in a new factory in Kenya. More than 100 are expected to be employed at the plant which will produce 10,000 vehicles each year, mostly trucks and buses. The plant will allow Foton to bypass Kenya's 25 percent import duty on vehicles

➲ ZAMBIA_APRIL: The Lumwana copper mine of Zambia may change hands after a $6.5 billion bid for Equinox Minerals - the mine's current owner - by Minmetals Resources of China. Minmetals has raised $5.9 billion worth of funding for the acquisition of Equinox, which produced nearly 150,000 tons of copper in 2010.

➲ ZIMBABWE_MARCH: The Export-Import Bank of China extended $700 million in loans to Zimbabwe. $342 million of the loaned value is apportioned for agricultural machinery while smaller sums will be used for health supplies and and water and sewer systems.

The ChinAfrica Econometer is produced by THE BEIJING AXIS, a cross-border business bridge to/from China in three principal areas: Strategy, Sourcing & Investment.

For more information, please contact: Barry van Wyk, barryvanwyk@thebeijingaxis.com

www.thebeijingaxis.com |