|

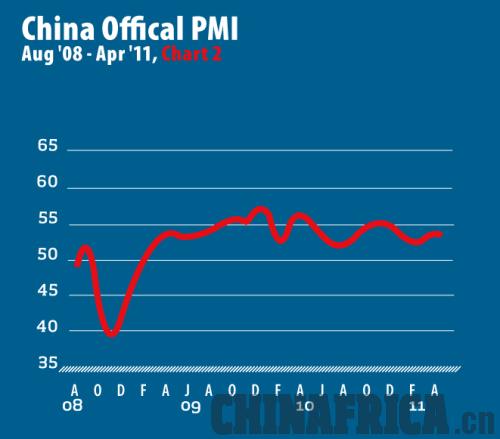

The large trade surplus in April suggests that China's exporters are still benefiting from a supportive exchange rate, yet this may be changing. Buyers of Chinese products around the world are set to feel the heat of higher prices as well, as China's currency, the Renminbi, has appreciated by 5 percent against the dollar since June 2010. Hence Chinese exporters are gradually marking up prices. The value of the Renminbi is a hot topic in China's bilateral relations with some of its largest trade partners, and the Renminbi may continue to rise as China seeks to dampen inflation. As an indication of the impact all these tightening measures are having in China, in April manufacturing growth decreased somewhat from March. The official Purchasing Manager's Index (PMI) dropped by 0.5 points to 52.9 from 53.4 in March (a reading above 50 indicates growth in manufacturing activity) (see Chart 2), while the value added of industrial enterprises was up 13.4 percent year-on-year in April, which was 1.4 percentage points lower than in March.

Expensive commodities

China's steel industry is counting the cost of surging global commodity prices (see Chart 3). According to the China Iron & Steel Association (CISA), of 77 steel companies tracked by its index, 10 registered net losses in the first quarter of the year, plagued by surging iron ore prices. It was a similar story for China's major thermal power plants, which registered less encouraging financial results in the first quarter amid the rising costs of coal and with capped electricity rates. Huadian Power and Huaneng Power all attributed losses in the first quarter to coal price hikes, while Datang Power – which had access to coal supplies at stable prices in the first quarter – saw its net profits increase five-fold. The Bohai Rim Steal Coal Price Index, an indicator of the costs of coal for power generation in China, hit a new high of 820 yuan ($126) on May 11. Iron ore imports decreased 11 percent in April month-on-month and 4 percent year-on-year, while copper imports fell 14 percent month-on-month and 40 percent year-on-year. As was the case in April, reduced imports of these commodities contributed to the pressure for higher prices in China, and there is as yet no end in sight for this problem China is having with rising prices.

|