|

Prioritizing Stability Over Growth

Although China's economy showed surprising resilience in July, China still faces intense inflationary pressures in the short-term along with medium- and long-term risks in the global economy.

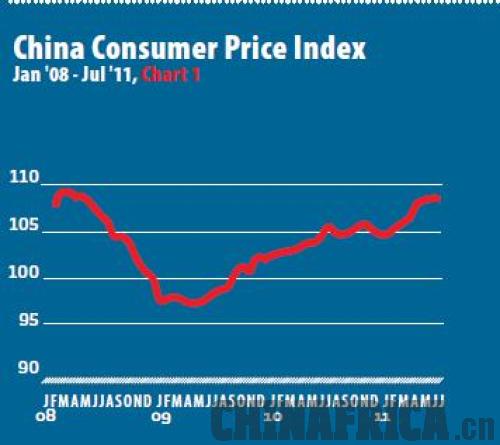

Even after a year and a half of monetary tightening, China's Consumer Price Index (CPI) increased further to 6.5 percent in July (see Chart 1), the highest level in more than three years. This was the fifth consecutive monthly increase, leading many to believe that inflation might finally be peaking in China. Food prices were once again the biggest contributor toward inflation, rising 14.8 percent in July. Until the CPI declines, inflation will remain China's biggest policy priority; accordingly, China's central bank will continue to employ monetary tightening measures even amid the ongoing turmoil in global financial markets.

Tightening measures affecting production

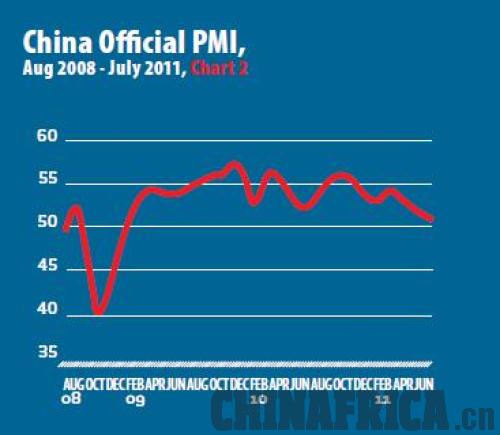

Industrial value-added output growth in China moderately declined to 14 percent year-on-year in July, down 1.1 percentage points from June, reflecting a slight decrease in industrial production among Chinese industries. Industrial production measures changes in output for the industrial sector of the economy and includes manufacturing, mining and utilities. In July, China's official Purchasing Managers Index (PMI) was 50.7, decreasing from 50.9 in June (see Chart 2). China's PMI now seems to be on the verge of contraction (a reading above 50 indicates expansion and below 50 indicates contraction). Small and medium-sized enterprises were probably the most affected by this slowdown due to funding shortages and rising production costs in coastal areas. Power shortages around the country in the summer season are also affecting production.

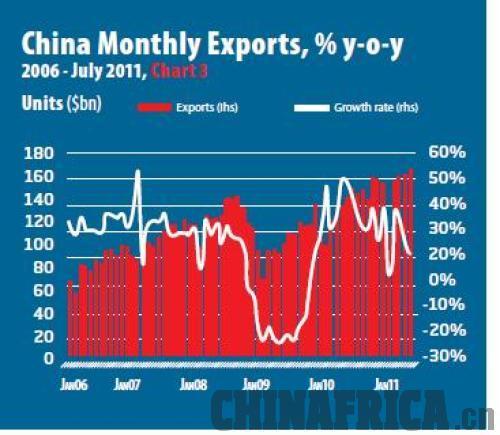

Exports in July rose a surprising 20.4 percent from a year ago to a record $175.1 billion (see Chart 3). Imports, on the other hand, rose a less-than-expected 22.9 percent from a year ago, to $143.6 billion, up from a near two-year low in June. Overall, the trade surplus widened to $31.5 billion in July, the highest figure since January 2009. However, these figures are expected to drop in the coming months due to the uncertainties facing the global economy.

Renminbi appreciation

Given the large trade surplus for July, the renminbi, which reached a new high against the U.S. dollar in July, will likely continue its appreciation in the second half of 2011. The renminbi has risen 3.1 percent against the U.S. dollar so far this year and 6.8 percent since June 2010, when China effectively ended the renminbi's peg to the dollar. While this will somewhat harm the competitiveness of China's exports, increased domestic demand from a stronger currency is expected to present other opportunities for businesses. The renminbi's continued appreciation is yet another sign that China's policymakers are willing to use all the tools at their disposal to rein in inflation.

As China continues to battle inflation through fiscal and monetary policies, overall growth is expected to slow in the second half of 2011. While China's competitiveness has shown resilience in the most recent trade data, the trend toward a stronger renminbi is expected to continue as China looks to restructure its economy to become more reliant on domestic demand. While China's policymakers will likely be very cautious in an uncertain global environment, they have already shown their willingness to sacrifice economic growth for economic stability in 2011.

|