|

Global Economic Slowdown Imminent

With inflation easing in August, China is now bracing itself for slower global economic growth by looking within its own borders.

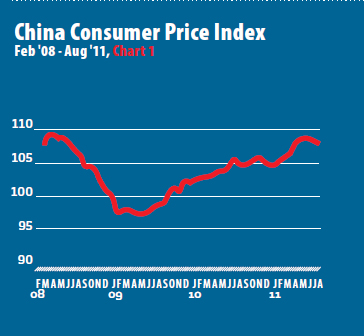

After more than a year and a half of monetary tightening, China's Consumer Price Index (CPI) eased slightly to 6.2 percent in August (see Chart 1), down from a three-year high of 6.5 percent in July and effectively marking the end of five consecutive monthly increases. Although inflation might have finally peaked, policymakers will unlikely ease tightening measures as long as the inflation rate remains above the government's target of 4 percent. Food prices were once again the biggest contributor toward inflation, rising 13.4 percent in August but lower than 14.8 percent experienced in July. There are concerns that food-driven is not only cyclical, it is becoming structural as well. Although inflation will remain China's biggest policy priority, China is unlikely to tighten policy further as its biggest economic markets, namely the United States and Europe, face tough economic prospects ahead.

Continuous trade growth

China's official Purchasing Managers' Index (PMI) rose to 50.9 in August from a 28-month low of 50.7 in July (see Chart 2). While China's PMI is pulling away from contraction, tight monetary policy at home and stagnant demand abroad, at best, are dimming chances that a sustained recovery can be achieved. Although the PMI has fallen steadily since March, actual annual factory growth output has remained above 13 percent. In the meantime, China seems to have circumvented a sustained production slowdown due to power shortages by implementing proactive policies such as power rationing measures during the busy summer season.

Exports in August rose 24.5 percent year-on-year, reaching $173.3 billion and accelerating even faster than the 20.4 percent increase from the previous month and slightly behind July's record $175.1 billion (see Chart 3). With sustained export growth, Chinese manufacturing products are remaining competitive in global markets. Imports rose even faster, surging to 30.2 percent year-on-year, to a record $155.6 billion, indicating that domestic demand remains strong even as the developed world struggles. Overall, the trade surplus narrowed to $17.8 billion, an almost 50 percent decrease from July's trade surplus of $31.5 billion. It becomes clear that China is increasingly looking within its own borders to sustain its economic growth.

Fate of cheap Chinese goods?

In recent months, it is an open secret that China has shown more willingness to let the renminbi appreciate, a move initially thought to ease inflationary pressures, but which will ultimately boost domestic demand for imported goods and lessen reliance on overseas demand. Higher production costs for capital, labor and materials, and subsequent more expensive Chinese manufactured goods in overseas markets, will also push domestic manufacturers to move up their value chains, a trend China's policymakers are also keen on realizing. Sustained weak demand from overseas will only accelerate this process.

Clouded world economic outlook

So far in 2011, China's economy has shown strong resilience as China's policymakers debate whether or not to ease tightening measures ahead of expected depressed demand from abroad in the coming months. China will continue to look for ways to accelerate the transformation of its economic growth model. In the meantime, China awaits, prepares, and braces for another round of slower global economic growth.

|