|

Growth expected to slow in the fourth quarter of 2011

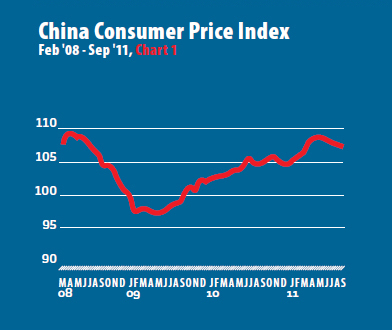

With inflation continuing to ease in September, China has put policy tightening measures on hold as a slowdown in Europe and the United States threatens global growth.

Inflation slowed slightly for consumers last month in China, with the Consumer Price Index (CPI) registering 6.1 percent for September (see Chart 1).Although stringent controls on bank lending and a gradually strengthening currency helped the CPI further ease from three-year highs, a closer look reveals food prices still rose rapidly, up 13.4 percent in September from a year earlier and unchanged from August. Overall, though inflation has slowed over the last two months, it remains well above the government's target of 4percent for the year .

Macroeconomic factors starting to slow trade

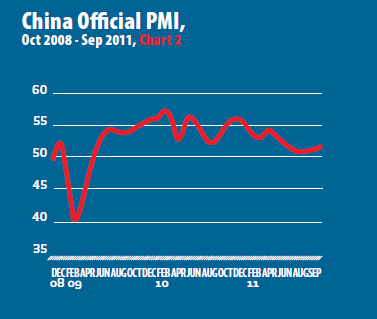

Factory activity in China picked up in September, with the official Purchasing Managers' Index (PMI) rising slightly to 51.2, up from 50.9 in August and the highest since May (see Chart 2). With the 50-point marking being the dividing line between expansion and contraction, September PMI shows China's manufacturing industry continues to pull away from contraction. While China is not shielded from slowdowns in the United States and Europe, its two biggest export markets, strong domestic demand and solid Asian export growth are offering some solace. Furthermore, the State Council's recent decision to provide more credit and fiscal support to cash-strapped small enterprises, which account for 75 percent of employment, will further erode fears that Chinese manufacturing will come to a complete standstill if a recession does take hold in key developed economies.

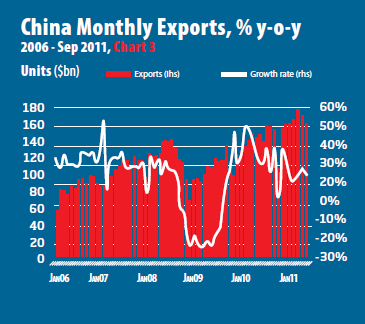

Trade data from September shows China's booming pace of export growth is beginning to ease as global turmoil and a gradual rise in the value of the renminbi are taking their toll. Exports rose by 17.1 percent in September from a year earlier to $169.7 billion.

However, reflecting the on-going sovereign debt crisis in Europe, Chinese exports to the European Union decreased by a significant 7.5 percent from the previous month. On the other hand, imports were up 20.9 percent year-on-year to $155.2 billion, slightly off August's record of $155.6 billion.

Overall, China's trade surplus narrowed for a second straight month in September to $14.51 billion from $17.76 billion in August, reflecting global economic weakness and cooling domestic demand. For the first three quarters of the year, China's trade surplus reached $107.1 billion, down 10.6 percent from a year earlier.

A looming trade war?

In October, the U.S. Senate passed a bill that would impose tariffs on certain Chinese goods if the Treasury Department determined that China was undervaluing its currency to its advantage.

Although the bill is not expected to become a law, it nevertheless displays the United States' growing impatience with its stagnant economy and uneven trade relationship with its second-largest trading partner. Passage of the bill will unlikely induce much change as Chinese authorities continue to resist calls for a faster rise in the currency, partly because they resent the pressure from the United States and also because they fear it would hurt Chinese exporters.. Overall, September's slower growth in exports suggests the appreciation of the renminbi is already affecting the competitiveness of Chinese exports and the trade surplus will likely further narrow the rest of the year, which will ease pressure on Beijing to appreciate its currency and help avert an all-out trade war.

Bracing for tougher times ahead

Observers say Chinese manufacturers are already importing significantly fewer parts and components which are used in products for export, suggesting export growth will continue to weaken in the months ahead. While signs point to the Chinese economy growing less rapidly the rest of the year, many economists say China is headed for a gradual slowdown, rather than a sharp halt similar to 2008.This time around, although China's fate is undoubtedly tied to the global economy, resilient domestic demand will help cushion China from a sharp downturn.

|