|

Moderating Inflation & Slowing

Growth Induces Policy Loosening

With inflation continuing to ease in October, China is now pondering whether to selectively loosen tight monetary policy to offset slowing global economic growth.

To the relief of consumers and policymakers alike, inflation continued to ease in China, with prices increasing by 5.5 percent in October from a year ago according to the Consumer Price Index (CPI) (see Chart 1). Inflation, which experienced its sharpest drop since hitting a three-year high in June, is projected to further slow in the coming months, and may hit 5 percent by the end of the year according to projections. The slowdown can largely be attributed to food prices, which rose 11.9 percent in October year-on-year and are typically one of the biggest drivers behind China's inflation. Although food makes up roughly a third of the government's official CPI figure, it can account for up to three fourths of expenditures for a rural family, a concern which is reflected in Premier Wen Jiabao's repeated pledge that tackling inflation remains the priority.

Weaker demand takes toll

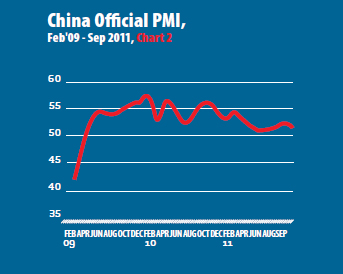

Factory activity unexpectedly fell in October, with the official Purchasing Managers' Index (PMI) sliding to 50.4, down from 51.2 in September and the lowest level since early 2009 (see Chart 2). A figure above 50 indicates expansion in manufacturing activity, while a figure below 50 means a contraction. The low reading likely signals a further slowdown in the economy largely due to tight monetary policy and weakening global demand for Chinese exports, particularly in Europe and the United States. While a moderate rebound in China's PMI in recent months had suggested China's manufacturing sector had weathered debt problems in China's biggest export markets, Europe is still grappling with its debt crisis, dampening the outlook for exports heading into the busy holiday season.

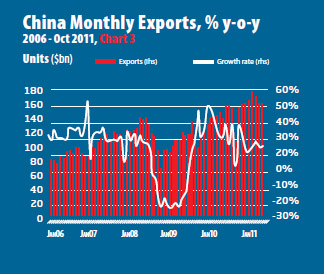

Imports into China rose sharply in October while export growth continued to slow, as China's policymakers strive to boost domestic demand to offset the effects of weakening demand for Chinese goods in Europe. Imports rose a stronger-than-expected 28.7 percent year-on-year, faster than September's 20.9 percent increase, which may reflect Chinese importers trying to take advantage of favorable prices to stock up on copper and other commodities. On the other hand, exports rose 15.9 percent year-on-year to $157.49 billion in October, down from $169.7 billion in September (see Chart 3). Imports grew by 28.7 percent to $140.46 billion in October, also lower than the $155.2 billion recorded a month earlier. Overall, China's trade surplus widened to $17 billion in October, up from $14.51 billion in September, which may perhaps lead to increased pressure on China to let its currency appreciate.

Time to loosen credit?

To clamp down on real estate speculation amid soaring housing prices, the Central Government has sought to create an artificial shortage of credit by setting undisclosed limits on how much money each bank can lend amid other measures. It has also begun cracking down on many shady forms such as neighborhood lending pools, which have historically been the lifeline for small businesses that are largely overlooked by China's large state-owned banks. Small businesses, which account for 75 percent of employment, are now struggling to secure financing to expand their operations, which would create more jobs. China must figure out ways for these small businesses to secure access to legitimate forms of financing on reasonable terms.

|