|

Trade Surplus at Six-Year Low

China looks to offset waning demand from overseas by boosting domestic consumption as inflation eases.

China's consumer inflation continued its recent decline, with the Consumer Price Index (CPI) slipping to 4.1 percent in December from a year ago (see Chart 1). It marked the fifth straight month of decline after inflation hit a three-year peak of 6.5 percent in July. While overall inflation continued to ease, a closer look reveals food inflation actually increased year-on-year to 9.1 percent, up from November's 8.8 percent increase. For 2011, December's CPI marked the closest it came to hitting the official target of 4 percent for the year, with the 12 month average rate hitting 5.4 percent. Although inflation will continue to be closely monitored in 2012, it is no longer the major concern for China's policymakers as worries continue to build about an economic slowdown.

Manufacturing rebounds

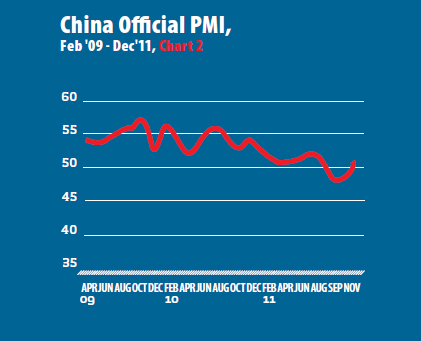

China's official Purchasing Managers' Index (PMI) for December rose to 50.3, an increase of 1.3 percentage points over November, as Chinese manufacturers narrowly avoided a contraction for the second consecutive month (see Chart 2). A figure above 50 indicates an expansion in manufacturing activity, while a figure below 50 indicates a contraction, suggesting that the world's second-largest economy will need fresh policy support to counter a slowdown in growth and maintain its momentary rebound in manufacturing activity.

Chinese officials continue to warn that waning demand from Europe and the United States, its two largest export markets, could put more pressure on Chinese exporters in coming months, especially as they momentarily halt production for the Chinese New Year holiday.

Meanwhile, China's export and import growth continued to slow in December. Exports rose 13.4 percent to $174.72 billion, slightly slower than the 13.8 percent rise registered in November, and its lowest level since February (see Chart 3). Imports increased 11.8 percent to $158.2 billion in December, compared with a rise of 22.1 percent in November. Due to the abrupt slowdown in imports, the overall trade surplus widened to $16.52 billion in December, up from the $14.53 billion surplus in the previous month. Slumping demand for Chinese goods abroad has prompted the government to loosen its monetary policy, while pledging to help struggling exporters by encouraging Chinese banks to increase their lending. For the year, imports were up 24.9 percent, while export growth came in at 20.3 percent, resulting in China's smallest trade surplus since 2005, suggesting it is becoming less reliant on exports. For the full year, China's exports rose 20.3 percent to $1.9 trillion while imports increased by 24.9 percent to $1.7 trillion. China's global trade surplus for 2011 was $155.2 billion, down 34 percent from 2010's $190 billion, marking the third consecutive fall in China's annual trade surplus.

China's relatively robust growth has been a rare bright spot for a struggling global economy. But growth has slowed in recent months after Beijing tightened lending and investment curbs to prevent overheating.

|