|

Inflation Dip Allows Policy Manoeuvring

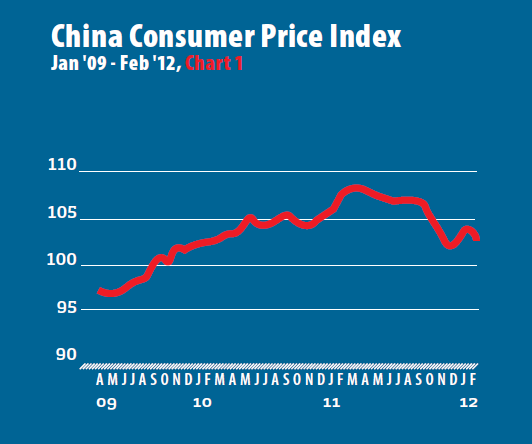

China registered a significant drop in inflation, with the CPI dropping to 3.2 percent in February, from 4.5 percent in January (see Chart 1). The sharp drop can partly be attributed to the fading of temporary price hikes related to heightened demand for goods and services during the Lunar New Year festival season. It also marked the smallest rise since June 2010, giving China's policymakers more leeway in steering the economy toward a soft landing. The Central Government recently announced it aims to keep average monthly inflation below 4 percent this year, unchanged from last year. However, endemic food inflation resulted in the 12-month average rate exceeding the target rate by 1.4 percentage points last year. In February, food inflation, which accounts for roughly one-third of the government's official inflation measurement, fell to 6.2 percent, from 10.5 percent in January.

Premier Wen Jiabao recently announced at the start of the 2012 National People's Congress' annual session that the government is aiming for economic growth of 7.5 percent in 2012, a slowdown from nearly a decade's long pursuit of 8 percent growth. The new target growth rate signals the government's determination to rebalance the economy by veering it away from a heavy reliance on exports and investment and more toward domestic consumption. Likewise, February's sharp drop in inflation also meant that real interest rates (return savers receive on their bank deposits) have edged into positive territory for the first time since the beginning of 2010. If this trend continues, households will not have to put away as much savings, thus having more discretionary income and boosting domestic consumption.

Manufacturing gains momentum

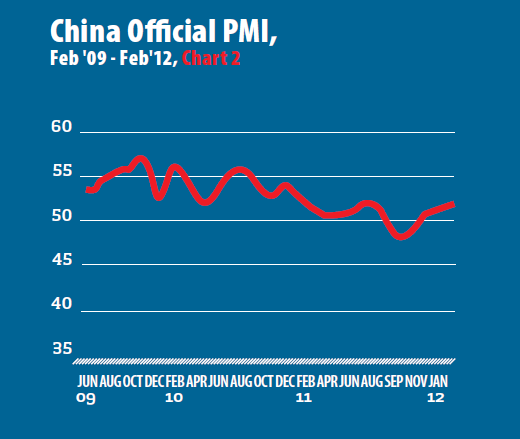

China's manufacturing activity continued its expansion in February, with the official Purchasing Managers' Index (PMI) rising to 51, its highest level since September, and an increase of 0.5 percentage points over January (see Chart 2). As a level of 50 demarcates expansion from contraction, it marked the third-straight month since China moved out of contractionary territory. Likewise, the sub-index for new export orders rose to 51.1 in February, its highest reading since May 2011 and the first indication of expansion in four months. The last figure suggests that demand for Chinese products from overseas markets is beginning to rebound, which will help prevent the factory sector from experiencing a hard economic landing. However some analysts suggest it's too early to believe that the government will ease back from pro-growth fine-tuning of economic policy.

Trade deficit balloons

China's monthly trade deficit reached $31.5 billion in February, its biggest such deficit in over a decade and in stark contrast to a record trade surplus of about $27.3 billion recorded in January. Overall, exports from China rose a slower-than-expected 18.4 percent from the previous year, reaching $114.47 billion (see Chart 3). Meanwhile imports registered a blistering 39.6 percent year-on-year growth rate to reach $145.9 billion, more than twice the rate of export growth, and the strongest rate since January 2011. For the two months combined, exports rose about 7 percent, while imports rose by about 7.7 percent. The fall in exports, which can be partly attributed to nationwide factory shutdowns during the Lunar New Year holiday, combined with strong commodities imports in the form of crude oil and iron ore, resulted in the largest trade deficit in years.

With growing signs of weakness in Europe, and more signs of more moderate growth and inflation easing in China, companies are pushing the government to use monetary and other policy measures to free up more money and stimulate growth, such as the reserve requirement ratio cut announced in mid-February which released about $63 billion into the economy.

|