|

Race for African Resources

Recently uncovered stores of mineral resources in East Africa will expedite competition between Chinese, Brazilian, Japanese, Indian, Russian, Irish and Anglo-Australian investors on the continent. Some of the new exploration findings include at least 70 trillion cubic feet of offshore gas reserves in Mozambique and Tanzania. Mozambique also has some of the world's largest untapped coking coal deposits, while Uganda enjoys at least 1.1 billion barrels of oil reserves.

While the firm and ever-increasing footprint of China in acquiring African resources has long been in the spotlight, the roles of the two other largest emerging economies in the world, Russia and Brazil, have often not been given enough attention to. There are signs, however, that this will change in the short term, with both countries becoming increasingly assertive in setting their own footprint in Africa. Russia, having very strong positions in Africa in the second half of the 20th century, ceded ground after the collapse of the USSR (Union of Soviet Socialist Republics). Now, after 20 years, Moscow has recently made tangible steps toward the reboot of its relationship with Africa. At the end of December 2011, the first "Russia-Africa" business forum was held in Addis Ababa (Ethiopia), and in 2012, Russia expects to formalize a cooperation strategy with Africa. The forum has seen participation from leaders of Russia's largest energy companies and banks, and African ministers of economy, finance and natural resources. Dozens of Russian companies are already racing for their own pieces of the African pie, as they think that it is the only continent where assets are still not over-valued and can be taken over for reasonable prices. Up to date, one of the most active Russian companies in Africa has been oil giant Lukoil (second-largest company after Rosneft and largest private oil company in Russia). So far, the focus of Lukoil has been oil-rich Western Africa, which can become the largest production center for the company outside of Russia. Currently, Lukoil has projects in three countries, Ghana, Côte d'Ivoire and Sierra Leone, with investments set to rise to $700-900 million, and with plans for further expansion into Gabon, Equatorial Guinea, Liberia and Uganda.

While for now Latin America may be the major supplier to Asia's insatiable demand for raw materials, in the future, this role will be played by Africa. Foreseeing this, some of Brazil's largest companies are already demonstrating a high commitment in the region. Vale, the world's largest iron ore producer, is expected to bring on-stream a $1.3 billion coal project in Mozambique and further push for production in the Simandou iron ore deposit in Guinea where it invested $2.5 billion for a stake this year. Over the next five years, the company plans to grow its investments in Africa, up to $15-20 billion worth. Brazil's top energy player, Petrobras, is building up its resource base in Africa as well, as seen through its recent acquisition of off-shore oil blocks in Benin and Gabon. This adds to the company's existing operations in Nigeria, Angola, Tanzania, Namibia and Libya.

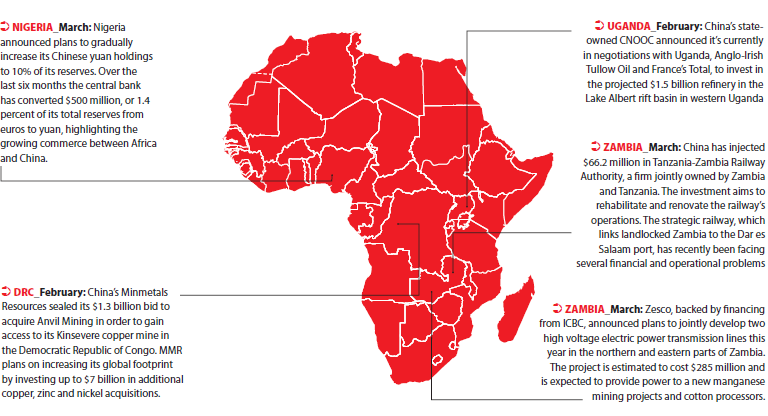

The ChinAfrica Econometer is produced by The Beijing Axis, a cross-border business bridge to/from China in four principal areas: Commodities, Capital, Procurement, & Strategy.

For more information, please contact: Barry van Wyk, barryvanwyk@thebeijingaxis.com

www.thebeijingaxis.com |