|

Growth Fears Spur Policy Shift

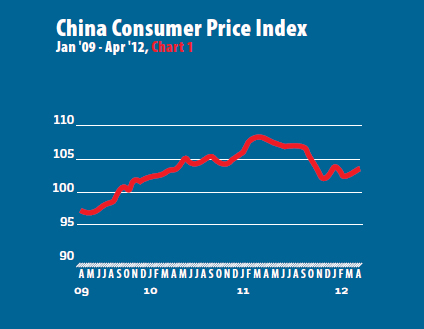

Inflation in China eased in April, with the Consumer Price Index (CPI) up 3.4 percent compared with a year earlier, slightly below the 3.6 percent registered in March (see Chart 1). April marked the third straight month inflation has stayed below the government's official target of 4 percent. Despite strong food price rises, the latest reading gives Beijing more room to loosen policy to help the economy rebound from a first-quarter slowdown in growth. Food inflation, which came in at 7 percent in April, also showed signs of moderating. The figure decreased from 7.5 percent in March, as falling pork and fruit prices offset an increase in vegetable prices.

Manufacturing momentum

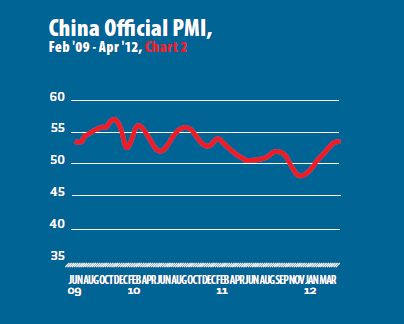

China's manufacturing activity extended its momentum in April, with the official Purchasing Managers' Index (PMI) rising to 53.3, its highest level in more than a year, and an increase of 0.2 percentage points over March (see Chart 2). The PMI gauges whether business conditions are improving or deteriorating, with a level of 50 demarcating expansion from contraction. The April reading marked the fifth-straight month manufacturing activity has stayed in expansionary territory. Export orders edged up to 52.2 from 51.9 in March, indicating that global demand remained steady despite weak demand from Europe. Meanwhile, factory output rose to a hefty 57.2 in April from 55.2 as manufacturers stepped up their restocking.

Weak trade data

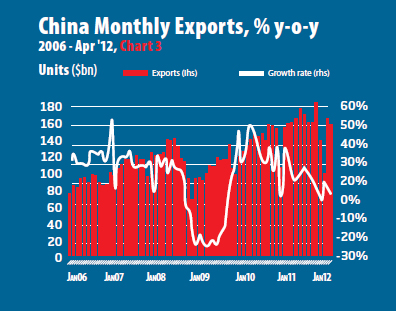

China's trade surplus jumped in April as imports and exports both further decelerated, renewing fears of a harder-than-expected landing. Exports grew by just 4.9 percent to $163.25 billion, down from $165.66 billion in March (see Chart 3). Underlining weak global demand for Chinese products, exports to the EU actually shrank 2.4 percent. Imports rose by a mere 0.3 percent year-on-year to reach $144.83 billion, its lowest such growth during a non-holiday month since the financial crisis. Overall, China's surplus jumped to $18.42 billion in April, more than three times the $5.35 billion surplus recorded in March and a deficit of $31.5 billion in February. The latest figures are also consistent with other recent data as export orders at the Canton Fair in south China, the world's biggest trade fair, shrank by 2.2 percent year-on-year, the first decline since the global financial crisis.

Stimulus measures reintroduced

Shortly following April's disappointing economic indicators, the People's Bank of China announced it would lower the share of deposits that large banks must hold in reserve by 0.5 percentage points to 20 percent, effective from May 18. This measure, the second of its kind this year, frees up an estimated $63.5 billion to kick start lending by banks and signals the government is willing to loosen policy to prevent the economy from slowing down any further.

Other measures likely to be considered are slowing the rate of yuan appreciation to help exporters, cutting interest rates to boost demand and investing more in infrastructure. A long-term oriented solution would be to increase interest rates on bank deposits to boost the spending power of ordinary consumers through a gradual reduction in the household-saving rate. China's next policy move will be instrumental in determining whether the Chinese Government is willing to sacrifice its desired long-term growth pattern and reform to prop up growth in the short term.

|