|

China's SEZs in Africa: What Future?

China-sponsored special economic zones (SEZs) in Africa are still in their early stages, and development of these zones on the continent has thus far not been problem-free. But the potential for Africa is huge if these zones can fulfil their goals.

These SEZs have in recent years become a mainstay of China's investment commitment to Africa. Yet how successful has China been in making these zones work? Indeed, have they produced any tangible results for Africa yet?

There are currently several of these SEZs in varying stages of development on the continent. One of the oldest and most developed SEZs is in Zambia's Copperbelt region. Built around a $250-million copper smelter project, the SEZ has come to include Chinese investment in the ancillary sectors of tin, uranium and diamonds, and is expected to reach completion in 2014 with a total investment of up to $1 billion. The oldest Chinese SEZ in Africa, however, is located in Egypt, where discussions had already commenced in 1994 on its construction. The Egyptian SEZ, focusing on textiles & garments, petroleum equipment, automobile and electronics assembly, initially experienced various problems but was eventually officially opened in 2009.

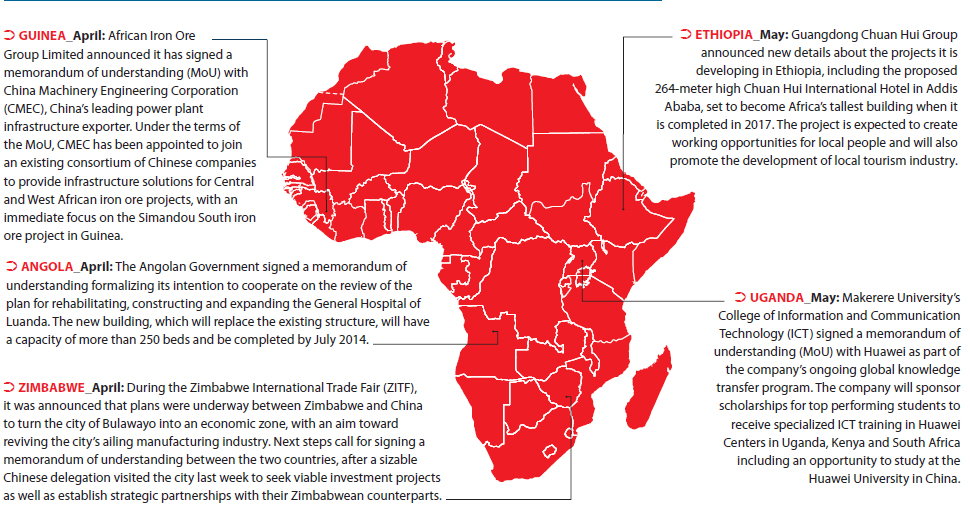

Other China-sponsored SEZs are under development in Nigeria, Ethiopia, Uganda and Mauritius, although none of these have yet to be formally opened. There are purportedly also discussions currently underway for additional SEZs in Tanzania, Mozambique and Angola (plans for an SEZ in Algeria were suspended following changes in Algerian legislation on foreign investment). Only the zones in Ethiopia and Mauritius are 100 percent Chinese-owned (the rest are joint ventures), and only one of these zones (in Zambia) is focused on mineral processing (the rest focus mainly on manufacturing).

Typically, development of the SEZ involves three parties: Chinese developers, African governments and the Chinese Government (along with local Chinese governments). Players from the Chinese Government side put out tenders and provide funding and support for Chinese developers operating in the zones, while African governments are expected to regulate activities in the SEZs and provide incentives for further development.

With the exception of the SEZ in Egypt, China-sponsored SEZs in Africa have yet to reach fruition, and some seem to be experiencing problems with lagging development (i.e. the Ethiopian SEZ). Yet as the Egyptian SEZ illustrates, SEZs in Africa require a very long development timeframe (anywhere between 10-15 years) due to the scale of construction required, and usually have to work through a maze of problems to become fully operational.

Despite these difficulties, the current environment of economic growth in Africa is better suited than ever for SEZs, and the payoff in new jobs and development in Africa will be substantial if China can successfully copy and adapt its SEZ model to the African continent.

The ChinAfrica Econometer is produced by The Beijing Axis, a cross-border business bridge to/from China in four principal areas: Commodities, Capital, Procurement, & Strategy.

For more information, please contact: Barry van Wyk, barryvanwyk@thebeijingaxis.com

www.thebeijingaxis.com |