|

Room for Stimulus as Growth Slows

Inflation in China slowed to a two-year low in May, with the Consumer Price Index (CPI) up 3.0 percent compared to a year earlier and down from April's 3.4 percent pace (see Chart 1). May marked the fourth straight month in which inflation has stayed below the government's official target of 4 percent for the year and gave policymakers additional room to loosen policy and stimulate growth. The cost of food, the main contributor to inflation last year, continued to moderate in May. Food prices were up 6.4 percent from a year earlier, slowing from April's 7 percent rate. Meanwhile, non-food prices were up 1.4 percent year on year, down from April's 1.8 percent.

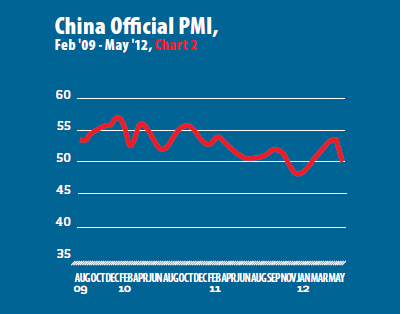

Manufacturing avoids contraction

China's manufacturing activity declined in April, with the official Purchasing Managers' Index (PMI) dropping to 50.4 in May, ending five straight months in which the index had risen (see Chart 2). The latest PMI reading revealed manufacturing is stalling as a level of 50 demarcates expansion from contraction. The 2.9-percentage-point decrease from April underscores the economy's weakness, with manufacturers now anticipating stimulus money to prop up demand. The factory output sub-index fell 4.3 points to 52.9, while the new orders sub-index was down 4.7 points to 49.8, signalling new business activity will decline, leading to a continued fall in economic growth. It will probably take a couple of months for the PMI to show a better reading.

Stronger trade data

As other indicators pointed to sluggishness in the Chinese economy, trade data for May provided a glimmer of hope for the world's second largest economy. China's trade surplus widened in May, as both domestic and external demands were much stronger than expected. May's surplus reached $18.7 billion, slightly higher than the $18.42 billion surplus recorded in April. Exports rose 15.3 percent in May year on year to reach an all-time high of $181.14, topping April's 4.9 percent pace (see Chart 3). Exports to Europe remain weak, with shipments rising a mere 1.3 percent so far in 2012. Offsetting waning demand from Europe, exports to the United States have risen 12 percent this year. Meanwhile, imports increased by 12.7 percent, reaching a record $162.44 billion and easily outpacing April's anaemic 0.3 percent increase. Imports were driven by the strength of China's appetite for commodities, although the demand outlook still remains shaky. Overall, economists doubt exports and imports can maintain such a fast pace in the coming months.

Time for action

Just prior to the release of weak economic indicators for May, the People's Bank of China (PBOC) unexpectedly cut benchmark lending and deposit rates by 0.25 percentage points, to 6.31 percent and 3.25 percent respectively, the first such cut since December 2008. The PBOC also widened the range within which they can move, leaving deposit rates free to float slightly higher and lending rates free to move slightly lower, a move aimed at helping consumers and businesses alike. In addition to the rate cut, China has rolled out a series of initiatives to support the economy, including purchase incentives for energy-efficient household appliances and targeted tax cuts. However, a large-scale economic stimulus package remains unlikely. While these new measures raise expectations that China's economy will bottom out in the second quarter, only structural reform that shifts activity more to consumers and private businesses will improve the nation's long-term growth outlook.

|