|

GDP Growth Hits Three-year Low

Inflation in China continued to ease in June, with the Consumer Price Index (CPI) hitting a 29-month low of 2.2 percent year on year, down from May's 3 percent rise (see Chart 1). June marked the fifth straight month inflation has stayed below the government's official target of 4 percent for the year, creating more room for policymakers to ease monetary policy and stimulate growth. Overall inflation has slowed to 3 percent in the first half of 2012, a significant decrease from the 5.4-percent increase for all of 2011. The cost of food, the main contributor to inflation last year, continued to moderate in June. Food prices, which make up roughly a third of CPI, were up 3.8 percent from a year earlier, slowing from April's 6.4-percent rate. Pork prices in particular fell 12.2 percent from 2011. Meanwhile, non-food prices remain unchanged at 1.4 percent.

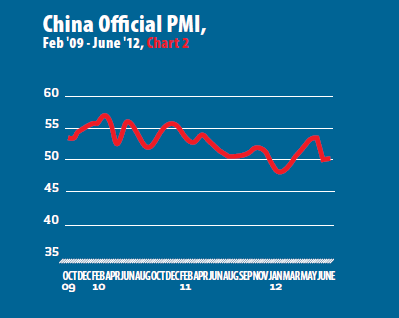

Manufacturing activity weakens

Manufacturing activity in China further weakened in May, with the official Purchasing Managers' Index (PMI) dropping to 50.2 in June, a seven-month low (see Chart 2). The latest PMI reading revealed manufacturing remains weak as a level of 50 demarcates expansion from contraction. The 0.2-percentage-point decrease from May underscores China's factory downturn and with a sharp fall in export orders and shrinking new orders, monetary policy is expected to be further relaxed to avoid a contraction. The sub-index for new export orders had its biggest monthly fall since 2011, dropping by 2.9 percentage points to 47.5, signalling foreign demand remained lacklustre. New orders, which include domestic orders, slipped 0.6 percentage points to 49.2, meaning factories received fewer orders in June compared to May, which can potentially drag down GDP growth in the third quarter. Even with new easing measures, a recovery in industrial output would take time, suggesting PMI readings may actually get worse before showing an improvement.

Trade surplus widens

Trade data for June also pointed to further sluggishness ahead in the Chinese economy. China's trade surplus widened to $31.7 billion in June, a significant increase from the $18.7 billion surplus recorded in May. Exports rose a better-than-expected 11.3 percent in June to reach $180.21 billion, near May's all-time high (see Chart 3). Meanwhile, imports increased by 6.3 percent to reach $148.48 billion, a significant slowdown from May's 12.7-percent growth rate and an indication that there was a drop-off in domestic demand while exporters ran down their inventories. China's exports to the European Union (EU), its largest trade partner, actually fell by 0.8 percent in the first half, which will greatly hinder the country's ability to meet its 10 percent target for trade growth in 2012. Meanwhile, the United States actually supplanted the EU to become China's largest export market in the first half of 2012. Overall, China's total trade surplus of $68.9 billion in the first half of 2012 represents a 56.4 percent year-on-year increase, which will likely lead to renewed trade tensions. Overall, China's exports in the first half of 2012 are still much better than the previous downturn at the end of 2008 and first half of 2009, lessening the likelihood of a large stimulus package.

GDP growth bottoming out

China's economic growth fell to 7.6 percent year on year in the second quarter, its slowest pace in three years. In anticipation of slower GDP growth, the People's Bank of China unexpectedly cut benchmark interest rates in July for the second time in less than a month in a bid to bolster growth in the second half of the year. It has also lowered banks' required reserves ratios (RRR) in three 50-basis-point steps since November 2011, freeing an estimated $190 billion to lend.

|