|

Weak Economic Indicators Stir Concern

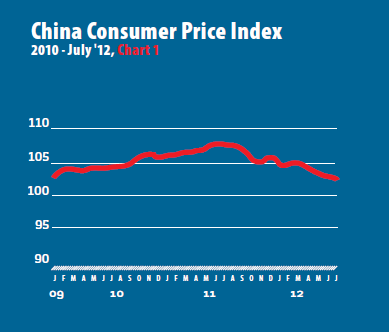

Inflation in China cooled further in July, with the Consumer Price Index (CPI) hitting a two-and-a-half-year low of 1.8 percent, down from the 2.2 percent rise registered in June (see Chart 1). July marked the sixth straight month inflation has stayed below the government's official target of 4 percent for the year, giving the government more leeway to maneuver monetary policy and stimulate growth. However, even with the drop in inflation, authorities are still closely monitoring food prices, the main contributor to inflation last year. More specifically, government officials have pre-emptively approached cooking oil companies, directing them to refrain from raising prices. China also announced it will release corn and rice from state reserves to help tame inflation, the first such release since September of last year. Overall, food inflation continued to moderate in July, with food prices up just 2.4 percent from a year earlier, slowing from June's 3.8 percent rate. Meanwhile, non-food prices increased by 1.5 percent, up a notch from June's 1.4 percent increase.

Manufacturing contraction?

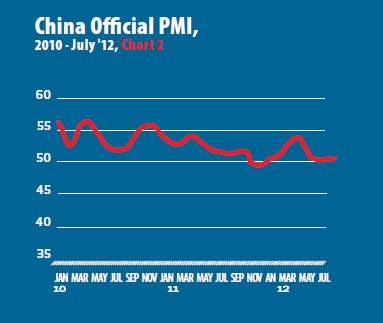

Manufacturing activity in China narrowly avoided a contraction in July, with the official Purchasing Managers' Index (PMI) inching down to 50.1, the lowest level since November (see Chart 2). The latest PMI reading revealed manufacturing activity is barely growing as a level of 50 demarcates expansion from contraction. The 0.1 decrease from June also showed stimulus measures have to reach manufacturers. According to the China Federation of Logistics and Purchasing (CFLP), the latest PMI reading reveals China's current economy is bottoming out and will continue its stabilizing trend in the following months. Furthermore, current demand is still relatively weak, and the downward pressure from oversupply has not been eliminated.

Weak trade data

Trade data for July did not offer any hints of a forthcoming rebound in China's economy. Exports rose a mere 1 percent in July to reach $176.9 billion, a significant slowdown compared to the 11.3 percent increase in June. This marked the second straight month of slowing export growth (see Chart 3). Meanwhile, imports increased by 4.7 percent to reach $151.8 billion, down from June's 6.3 percent growth rate. As a result, China's trade surplus narrowed to $25.1 billion from $31.7 billion in June. While July's visible fall in export growth was not surprising given the weakening of global demand in recent quarters, the magnitude of the fall in July was quite striking and a cause for concern. From a holistic perspective, the latest data demonstrates that China cannot grow via exports in the current global environment, and that trade will continue to subtract from its GDP growth.

New stimulus measures

Despite two interest rate cuts this year, the latest data suggests China's economy has not yet stabilized, as export growth, factory output and retail sales all weakened from the same period of last year. Experts are expecting the government to cut interest rates at least once more in 2012 and to be more aggressive in cutting the reserve requirement ratio going forward. Other measures the government has taken thus far include fast-tracking investment projects and encouraging energy-efficient consumer spending. There are also hints from top government officials that China will look more closely at employment, ensuring unemployment does not spike in a slowing economy.

|