|

WEAK INDICATORS HEIGHTENING CONCERNS

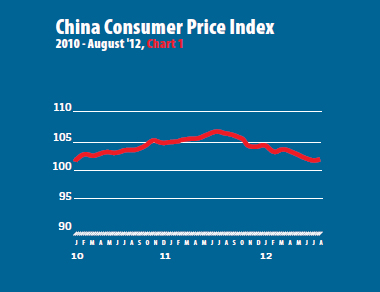

Inflation in China rose in August, with the Consumer Price Index (CPI) rising 2 percent, up from July's 30-month low of 1.8 percent (see Chart 1). While August marked the seventh straight month inflation stayed below the government's official target of 4 percent for the year, the increase effectively narrows the room for policy easing. The rise in inflation can be largely attributed to a turnaround in pork prices, which climbed after falling during the summer season. The government is heavily promoting huge industrial farms to increase economies of scale as part of a long term plan to calm volatile pork cycles and bring inflation more under control. Overall, food inflation in August rose 3.4 percent, up from 2.4 percent in July, while non-food prices rose 1.4 percent, down from 1.5 percent in July.

Manufacturing contracts

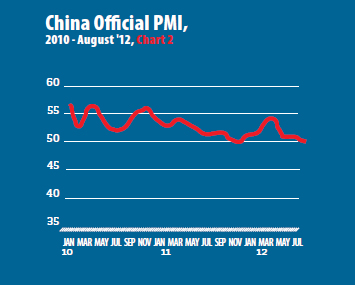

After three months of teetering on contraction, manufacturing activity in China officially contracted in August, with the Purchasing Managers' Index (PMI) declining to 49.2, the lowest level since November last year(see Chart 2). A reading of 50 percent demarcates expansion from contraction. The 0.9 decrease from July also showed stimulus measures have yet to reach manufacturers. The sub-index for new orders in August hit 48.7 percent, down 0.3 percentage points from July, signifying that demand for China's manufactured goods is declining. With forecasts predicting both domestic demand and external demand to rebound in the fourth quarter, August and September might be the toughest period for China's economy this year.

Weak trade data

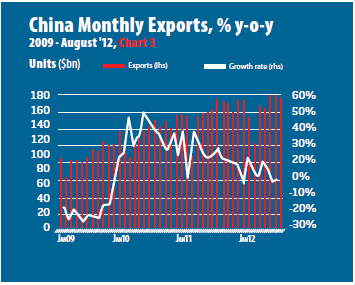

Trade data for August further added to concerns about China's slowing economy. Exports rose a mere 2.7 percent in August to reach $178 billion, slightly above July's 1 percent increase but still weak overall (see Chart 3). Much of this weakness comes from crisis-hit Europe, China's biggest trading partner, as exports to the EU fell 12.7 percent in August from a year earlier.

Meanwhile, imports fell 2.6 percent, sliding to $151.3 billion and indicating a decline in domestic consumption. Overall, China's trade surplus widened to $26.7 billion, up from $25.1 billion in July. The fall in imports was particularly striking given that China has been trying to boost domestic demand in a bid to rebalance its growth and offset slowing demand for exports. Beijing's target of 10 percent growth in overall trade set at the beginning of the year seems unrealistic, given that year-to-date growth has reached just 6.2 percent through the end of August.

Infrastructure to boost growth

At the beginning of September, the Central Government revealed approved plans for $158 billion in infrastructure spending, an investment push that will help support growth in the stuttering economy. The government has been careful not to describe the investments as a stimulus package per say, but the announcements did give renewed optimism about China's prospects in the short to mid term. The plans also signaled that China's Central Government has started to take decisive action amid clear signs of a worsening slowdown of economic growth. In other words, policymakers are taking measures now to ensure GDP does not drop for an eight consecutive quarter in the October-December period.

|