| Light at the End of the Tunnel?

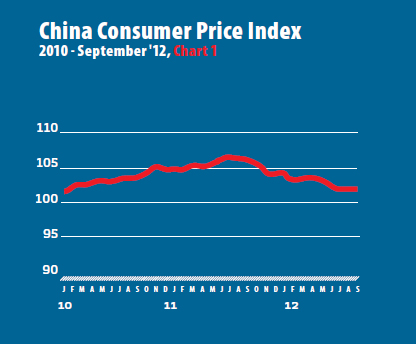

Inflation in China eased in September, with the Consumer Price Index (CPI) slipping to 1.9 percent, down from the 2.0 percent registered in August (see Chart 1). September marked the eighth straight month inflation has stayed below the government's official target of 4 percent for the year. The decrease effectively gives more room for policymakers to take additional measures to boost the economy. Ever since the People's Bank of China (PBC) cut interest rates (once in June and again in July), China watchers have been anticipating more monetary easing. However, the PBC has yet to touch either the interest rate or its reserve requirement ratio for banks – currently among the highest in the world. While some economists warn of a possible rebound in prices in the months ahead, others insist there is a bigger need for additional stimulus.

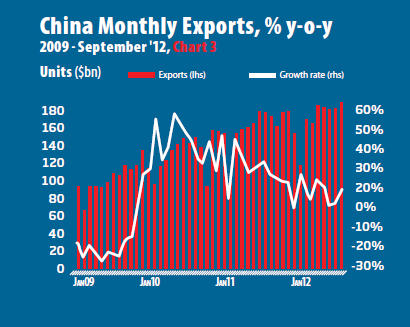

Promising trade data

Trade data for September hinted that China's economy is finally reaching a turning point as exports rose on improved overseas demand and imports recovered slightly. Exports rose a solid 9.9 percent year on year to reach a record $186.4 billion, much higher than August's 2.7 percent increase (see Chart 3). Meanwhile, imports rose by 2.4 percent to reach $158.7 billion, in contrast to a 2.6 percent fall in August. Overall, China's trade surplus expanded to $27.7 billion, up from $26.7 billion in August. While September's trade data offered a positive sign for the Chinese economy, it remains to be seen whether import and export growth can remain at these levels, especially since unfavorable economic fundamentals in the United States and the European Union – China's two largest trading partners – continue to raise uncertainties. Year to date, exports to the United States have fared well this year, showing a 9.6 percent increase. However, exports to the European Union have struggled, falling 5.6 percent over the same period as the European sovereign-debt crisis continues to take a heavy toll. Even with September's promising trade figures, Beijing's target of 10 percent growth in overall trade set at the beginning of the year seems unrealistic, as double-digit growth will be required in the months ahead to achieve this.

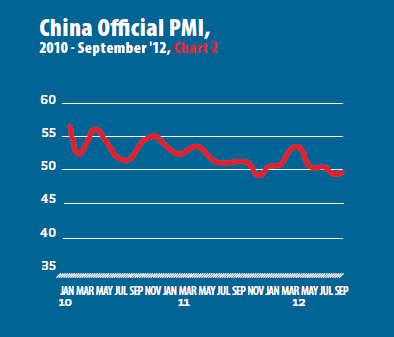

Manufacturing contracts

Manufacturing activity in China remained in contractionary territory for a second successive month, with the Purchasing Managers' Index (PMI) rising to 49.8 percent in September, up slightly from August (see Chart 2). A reading of 50 percent demarcates expansion from contraction. August had marked the lowest reading since November 2011, as China continues to struggle with slowing exports, factory output and fixed asset investment.The sub-index for new orders strengthened to 49.8 percent, suggesting a diminishing rate of slowdown in orders coming from factory customers. Meanwhile, the output sub-index also strengthened to 51.3 percent. One measure the government has taken to boost confidence is quickening the payment of tax rebates to exporters. Overall, forecasts are predicting GDP growth in the third quarter to slow to 7.4 percent, down from the 7.6 percent growth registered in the second quarter.

Boosting money supply

While China's monthly economic indicators for September offered a positive sign ahead of what's expected to be the weakest quarterly economic growth report in more than three years, it is not clear whether signs of increased money supply in China's financial system will be enough to reignite faster growth. China's broadest measure of money supply, M2, was up 14.8 percent year on year at the end of September, above the PBC's target of 14 percent growth in M2 for the year. The PBC has actively injected liquidity into the interbank market as part of its effort to ease monetary conditions and bolster a slowing economy, injecting a record weekly amount ($58 billion) in the last week of September.

|