|

Signs of a Fourth Quarter Rebound

Inflation in China continued to moderate in October, with the Consumer Price Index (CPI) unexpectedly slipping to 1.7 percent, down from the 1.9 percent registered in September (see Chart 1). October marked the lowest inflation rate in nearly three years, giving the government more room to further stimulate the economy if necessary. Food prices, which are closely monitored by authorities, were subdued, rising 1.8 percent year on year, compared with a 1.7 percent rise for non-food prices. October's CPI reading is expected to mark the bottom of the current inflation cycle as economists forecast inflation to gradually increase over the next few months on the back of rising food prices.

Promising trade data

Export growth accelerated at the fastest pace in five months in October, marking the second straight month of surprisingly strong export data. China's October exports rose 11.6 percent from a year earlier, faster than September's 9.9 percent rise, to reach $175.6 billion (see Chart 3). Meanwhile, imports rose a less impressive 2.4 percent – unchanged from September – resulting in China's overall trade surplus widening to $32 billion in October. Political tensions between China and Japan continued to affect their trade relations, with China's imports from Japan falling 10.1 percent year on year in October, and down 6.8 percent year to date. Exports to the United States have remained resilient throughout the year and were up 9.1 percent in October. Sustained double-digit export growth is likely to remain elusive due to the looming U.S. fiscal cliff and continued sovereign debt woes in Europe.

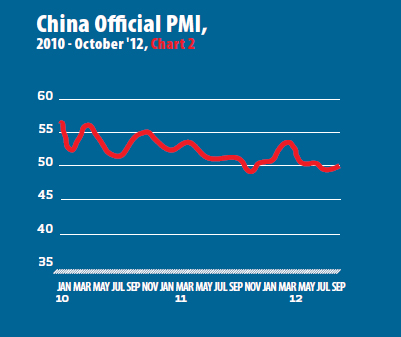

Manufacturing shifts to expansion

China's manufacturing expanded for the first time in three months in October, with the official Purchasing Managers' Index (PMI) rising to 50.2, from 49.8 in September (see Chart 2). The index is based on responses from purchasing managers at 820 companies in 31 industries, with a reading of 50 demarcating expansion from contraction. The latest reading was another sign that growth in the world's second-biggest economy is rebounding after a seven-quarter slowdown as large manufacturing enterprises have started to expand their manufacturing activities. China's economy expanded 7.4 percent in the third quarter from a year earlier, the slowest pace in three years.

Economy heats up in winter

With China's economy exhibiting stronger growth signals over the last two months, forecasters are predicting this trend will continue in the months ahead due to various factors. Firstly, government spending is expected to surge in the final months of the year, as unused funds are spent, contributing to a flood of liquidity and stronger demand. Secondly, throughout most of the year, exporters had been holding off converting their U.S. dollars into yuan in anticipation that the yuan will appreciate. With the yuan rising at an annualized pace of 7.4 percent against the U.S. dollar in October alone, exporters are expected to take advantage of a more favorable exchange rate, boosting liquidity in the process. Thirdly, all signs point to the People's Bank of China keeping monetary conditions relaxed for the time being, exemplified by a record $60.2 billion injection into the banking system via open market operations at the end of October.2012

|