|

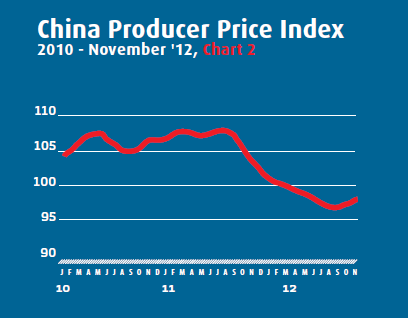

Inflation in China rebounded from 33-month lows in November, with the Consumer Price Index (CPI) rising to 2.0 percent, up from the 1.7 percent registered in October (see Chart 1). The slight increase dimmed chances for monetary policy easing as the economy continues to recover. Food was the key driver of consumer prices, with vegetable prices alone jumping 11.3 percent year on year. Factory gate prices also gained momentum, as the Producer Price Index (PPI) fell by 2.2 percent in November, easing from October's 2.8 percent drop (see Chart 2). While China's producer prices have dropped for nine straight months due to slower export growth and slumping domestic demand, the latest PPI reading should provide a boost to firms struggling with falling profits.

Manufacturing continues to expand

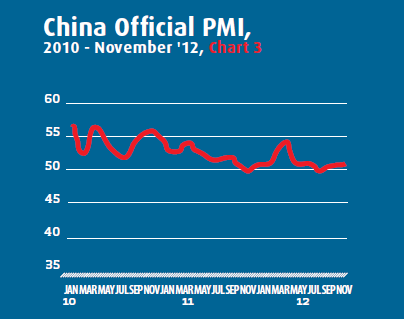

China's manufacturing sector continued to expand in November, with the official Purchasing Managers' Index (PMI) rising to 50.6, a seventh-month high, from 50.2 in October (see Chart 3). The index is based on responses from purchasing managers at 820 companies across 31 industries, with a reading above 50 indicating an expansion in manufacturing activity. Eight of 11 sub-indexes rose from a month earlier, with the new orders sub-index rising to 51.2 from 50.4, suggesting output will rise further in the coming months. Export orders also rose to 50.2 from 49.3, indicating that external demand for Chinese-made goods is improving.

Consumption revs up, trade weakens

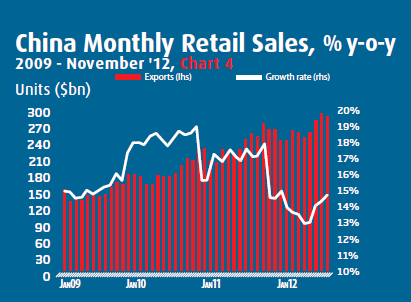

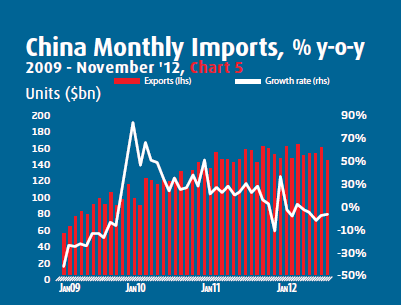

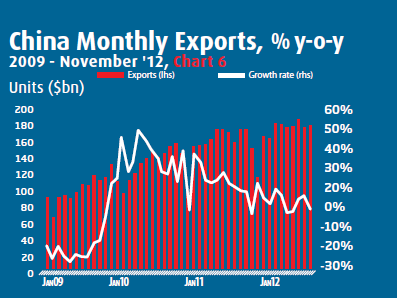

Retail sales, one of the country's key growth drivers, grew 14.9 percent in November from a year earlier, the fastest pace in eight months (see Chart 4). Urban consumption expanded 15 percent while rural residents spent 14.6 percent more on goods and services than a year earlier. Meanwhile, imports were flat at $159.7 billion (see Chart 5) while exports from China edged up in November, highlighting the uncertainty surrounding global demand as China strives to reverse seven straight quarters of declining GDP growth. China's November exports rose 2.9 percent from a year earlier, slower than October's 11.6 percent rise, to reach $179.4 billion (see Chart 6). Exports are likely to grow by a less-than-impressive 5 percent next year.

New Year, New Policy?

China's newly appointed leaders expressed their strongest signal yet that their top economic priority is to remake the economy by relying more on domestic demand and less on exports and investment in capital-intensive state-owned companies. In a statement issued after the annual Central Economic Work Conference in December, Beijing's policymakers stated they will seek to boost imports and speed the integration of rural migrants into cities in order to boost domestic consumption. The reasoning is that rural migrants can earn far more money working in China's cities than they can in their home villages, giving them a lot more cash to spend.

|