|

Uneven Economic Recovery

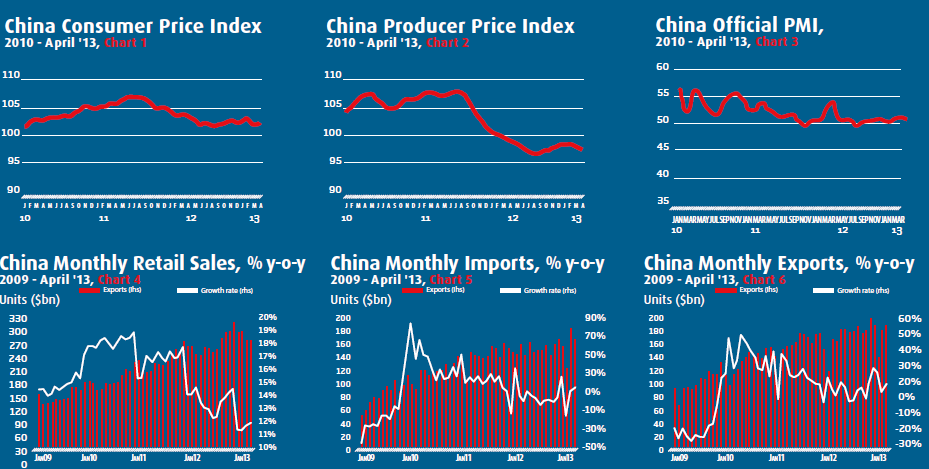

China's inflation quickened to 2.4 percent year on year in April, faster than the 2.1-percent rise registered in March (see Chart 1). However, with the CPI topping 3 percent only once since last June, inflation remains relatively tame for the time being, leaving room for policy makers to stimulate the economy if needed. In the meantime, the government will also put a renewed focus on stabilizing food prices, which were up 4 percent in April. Meanwhile, the Producer Price Index (PPI), which has been declining for more than a year, fell further into negative territory in April to 1.9 percent (see Chart 2). Downward pressure on producer prices due to weak demand amidst excess capacity is eroding the profits of Chinese manufacturers.

Controlling inflows

Faced with the risk that inflows of speculative capital could cause the yuan to appreciate too quickly in that it destabilizes exports and the overall economy, the People's Bank of China (PBOC) has begun intervening heavily in the domestic currency market this year, buying up dollars and selling yuan. In May, the PBOC announced it would auction $1.6 billion worth of three-month bills, the first of its kind since 2011, in order to drain liquidity. The move suggests that the PBOC is preparing to make systematic longer-term cash drains from the money supply to blunt the impact of hot money inflows, which can potentially impact interest rates, market sentiment and economic growth.

Strong trade growth

Retail sales growth slightly accelerated to 12.8 percent year on year in April, faster than the 12.6-percent rise in March (see Chart 4). China's trade growth also accelerated in April in another positive sign for the country's economic recovery. Imports continued their momentum, rising 16.8 percent to reach $168.9 billion and signalling that domestic demand was gathering steam needed to drive economic recovery (see Chart 5). Exports continued their double-digit growth pace, surging 14.7 percent to reach $186.1 billion after rising 10 percent in March (see Chart 6). However, the strong export data in recent months has met some scepticism. Some analysts suspect that some Chinese exporters may be overstating their business to avoid capital restrictions on funds they are bringing into the country. Accordingly, the State Administration of Foreign Exchange (SAFE), China's foreign exchange regulator, stated it would increase its scrutiny of export invoices and impose tougher penalties on firms providing false data.

Manufacturing disappoints

China's official Purchasing Managers' Index (PMI) for the manufacturing sector unexpectedly fell to 50.6 in April, down from an 11-month high of 50.9 in March (see Chart 3). A PMI reading above 50 indicates an expansion in manufacturing activity from the previous month, whereas a reading below 50 indicates contraction. The latest reading suggests China's exporters are facing headwinds from the euro zone recession and sluggish growth in the United States and raises fresh doubts about the strength of the economy after a disappointing first quarter. Many analysts now expect economic growth to ease again in the second quarter.

|