|

Economy Improves Across the Board

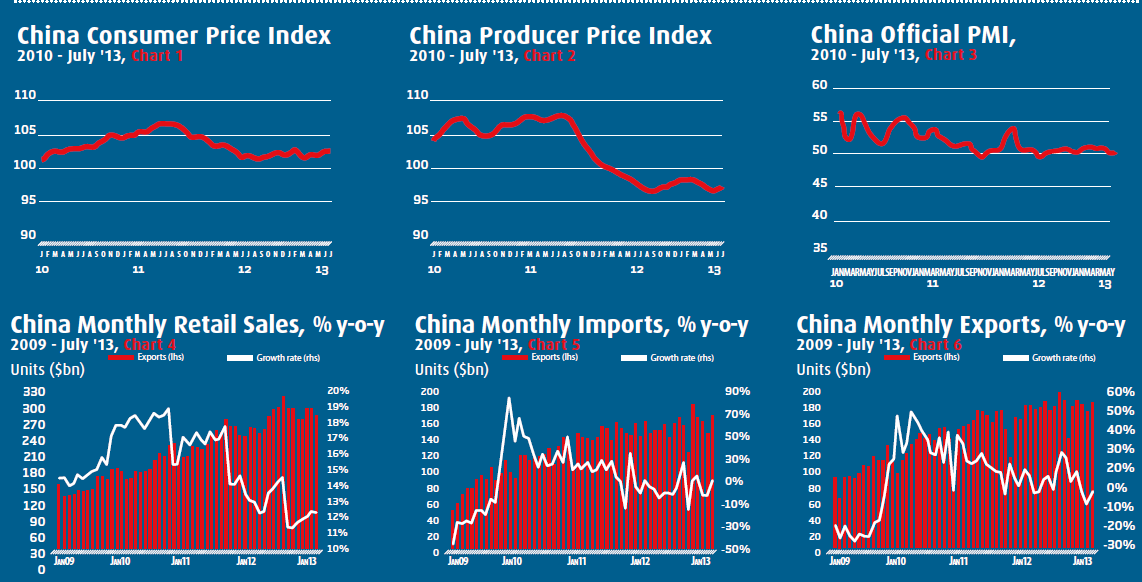

Chinaís inflation remained subdued in July, with the Consumer Price Index (CPI) rising 2.7 percent year on year, the same as in June (see Chart 1). The latest inflation figure gives authorities some leeway to stimulate the economy with interest rate cuts or increased government spending. Meanwhile, the Producer Price Index (PPI) fell 2.3 percent, narrowing from a fall of 2.7 percent in June (see Chart 2). Factory-gate prices suggest that demand might be strengthening after a slump that has caused producer prices to decline steadily for more than a year. While consumer inflation is not expected to be an issue this year, producer-price figures are a reflection of the severe overcapacity in many industries, necessitating further policy changes.

Restructuring the economy

The Politburo, Chinaís top decision-making body, has pledged stable economic growth in the second half of this year as it presses ahead with reforms and restructuring. Chinaís leaders are working to turn the economy into one led by domestic consumption and demand from a focus on manufacturing and exports, but those changes raise the possibility of job losses as traditional industries restructure. Companies in industries including steel, cement and glass have been ordered by the authorities to shut down some factories to reduce excess production capacity. Chinaís leaders will continue to focus on reforms aimed at supporting entrepreneurs and encouraging domestic consumption to reduce Chinaís reliance on exports and investment.

Manufacturing strengthens

Chinaís official Purchasing Managersí Index (PMI) for the manufacturing sector rose to 50.3 in July, up from 50.1 in June (see Chart 3). A PMI reading above 50 indicates an expansion in manufacturing activity from the previous month, whereas a reading below 50 indicates contraction. Chinaís official PMI suggests services are growing faster than manufacturing. The services measure has hovered between 53.9 and 56.7 in the past 12 months, while manufacturing has fluctuated between 49.2 and 50.9.

Trade expands

While retail sales growth slowed slightly to 13.2 percent in July, this is higher than the 12.7-percent increase registered in the first half of 2013 (see Chart 4). Closer analysis reveals retail sales growth in rural areas (15 percent) outpaced that of urban regions (12.9 percent). A stronger-than-expected rebound in Chinaís exports and imports in July offered hope that the economy may be stabilizing after a slowdown that has prompted the government to shore up activity.

Following two straight months of decline, imports jumped 10.9 percent from a year earlier to reach $168.2 billion (see Chart 5). After suffering its first fall in exports in 17 months in June, Chinaís exports rose 5.1percent in July from a year ago to reach $186 billion (see Chart 6). Exports have been hurt by weak demand in the United States and Europe, with anemic global growth forcing consumers to tighten their spending habits.

Chinese Investment

in African Potash Deposits

While China has been largely self-sufficient due to its exponential growth over the past few decades, it now demands more resources, namely food, to supply its needs. China has 20 percent of the worldís population, yet only 10 percent of the worldís arable land. Thus, to meet the demands of the population, the Chinese Government has encouraged domestic companies and investors to invest in natural resources abroad, including potash, a key ingredient used in the production of fertilizer.

Potash - located deep underground and formed from the compression of pre-historic oceans into minerals - is one of the worldís most sought-after commodities. For the past decade, China, along with India, has been forced to pay high prices to Uralkaliís Belarus Potash Co. (BPC) and Canpotex, a North American producer group, which collectively control over 70 percent of the global supply. This has been disadvantageous to China, which accounts for 29 percent of global demand.

Although 150 countries import potash, only a dozen actually produce it, with two thirds of production coming from European and North American cartels. Hoping to break this regimen, China, the worldís largest importer of potash, has made a concerted effort to invest in Central African potash resources to secure enough of the commodity to maintain its 50 percent import requirement and feed its giant population.

This comes as advances in exploration technology and increases in FDI have allowed for the discovery of unknown potash deposits in Africa. The largest untapped reserves of potash lie in Ethiopia, which, unlike most other global sources, has deposits closer to the Earthís surface, which is cheaper to extract. According to UN Comtrade statistics, Ethiopian potash exports to China nearly doubled from $1.62 million in 2010 to $3.13 million in 2011. This trend is clearly only the beginning.

An earlier investment in Africa came from ChinaCo, a large state-run exploration company. In 2009, it entered into a joint venture with Allana Corp., a Canada-based firm, to build a potash mine in the Danakil Evaporate Basin, which extends into northeast Ethiopia. ChinaCo also agreed to purchase a 19.99-percent stake in the company, as well as subsidize 70 percent of the mine development project as part of the deal. A recent report indicates that 1.3 billion tons of the resource can be extracted, with production slated to start in 2014.

A more recent player to secure this commodity is the China-Africa Development Fund, a wholly-owned subsidiary of the China Development Bank, which is set to invest around $100 million this year in a potash project run by the Hong Kong-listed Dingyi Group in the Republic of the Congo.

Traditionally, the potash trade has been disadvantageous for China, which wielded little or no pricing power in the market due to the dominant cartels. However, since recent internal conflicts broke up Uralkaliís BPC, prices are predicted to fall by as much as 25 percent by early next year.

With the cartelís stronghold on supply restrictions and prices diminishing, China now has the upper hand due to the vast volumes it imports and its strategic positioning to expand its supply. This will not only aid China in sustaining a future for its arable production and population needs, but also push additional FDI into Africa, helping to further develop the continentís own infrastructure and subsequent economic growth.

The ChinAfrica Econometer is produced by The Beijing Axis,

a China-focused international advisory firm operating in four principal areas:

Commodities, Capital, Procurement, and Strategy.

For more information, please contact:

Daniel Galvez, danielgalvez@thebeijingaxis.com

www.thebeijingaxis.com |