|

Economy Continues Steady Recovery

Chinaís consumer inflation picked up in September, with the Consumer Price Index (CPI) rising 3.1 percent year on year, its fastest pace in seven months (see Chart 1). Even with the latest increase, policy makers are still on target to keep the consumer inflation rate within about 3.5 percent this year. The CPI increase was mostly due to seasonal factors pushing food prices higher, with fresh vegetable prices surging 18.9 percent. Meanwhile, the Producer Price Index (PPI) fell 1.3 percent, the least in 18 months (see Chart 2). While forecasts predict factory price inflation will probably remain negative through the end of the year, the latest data suggests the worst is over. Overall, mild inflation means that the government still has room for pro-growth policies without having to worry about triggering a sharp upturn in prices.

Manufacturing edges up

Chinaís official Purchasing Managersí Index (PMI) for the manufacturing sector picked up slightly to 51.1 in September, a 16-month high (see Chart 3). A PMI reading above 50 indicates an expansion in manufacturing activity from the previous month, whereas a reading below 50 indicates contraction. The latest PMI showed a continued growth in exports, with a sub-index rising to 50.7 in September, up from 50.2. However, small businesses, which have difficulties getting access to capital from Chinaís large state-owned banks, continue to struggle, with the small business sub-index remaining in contractionary territory.

Exports lose momentum

Retail sales growth slightly decelerated to 13.2 percent in September, 0.1 percentage point lower than the 13.3-percent increase registered in August (see Chart 4). On the external front, Chinaís exports unexpectedly shrank in September, reflecting weakening global demand for its products and a potential headwind for its on-going recovery. On a positive note, imports gained momentum in September, registering a 7.4-percent growth rate to reach $170.4 billion (see Chart 5). Partly due to a strengthening renminbi, Chinaís exports fell 0.3 percent in September to reach $185.6 billion (see Chart 6). The growth in imports coupled with the sharp downturn in exports narrowed Chinaís surplus to $15.2 billion.

Q3 GDP growth picks up

In line with expectations, Chinaís GDP grew by 7.8 percent in the third quarter, up from the 7.5 percent registered in the previous quarter.Beijinghas set a hard growth target of 7.5 percent for 2013, which would be the weakest rate in more than 20 years. However, Chinaís leadership has repeatedly stated it would accept slower growth as it tries to restructure the economy to be driven by consumer demand, rather than investment, credit and exports. The Communist Party of China leaders are set to meet in November to discuss key economic policy reforms, which include reducing the stateís hand in the economy and financial system and experimenting with loosening restrictions in free trade zones.

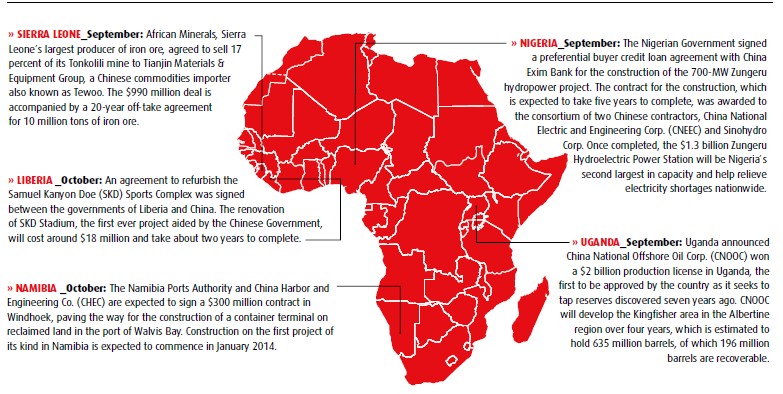

Africa primed for bigger rolein global economy

WhileChinahas long been a catalyst to world economic growth, Africa is in a prime position to take the torch as the two economiesí fates become increasingly intertwined.Chinaaccounted for 18.1 percent of Africaís total trade volume in 2012, up from a mere 3.8 percent in 2000. When taking into account its third quarter real growth rate of 7.8 percent,Chinawill nominally add more than $820 billion to its economy in 2013 alone, equivalent to adding South Africaís economy more than twice over.

Despite a poor global economy, the value of exports fromSouth AfricatoChinacontinues to grow while South Africaís next three largest export destinations (theUnited States,JapanandGermany) have all seen a marked decrease in demand since 2011. South Africaís impressive export growth toChinais rapidly increasing its visibility to Chinese businesses, which needs to be further leveraged to show thatSouth Africaand Africa as a whole have an increasingly sophisticated manufacturing sector that produces a growing number of competitive value-added goods. South Africaís Department of Trade and Industry (DTI) for example has identified strategic industries inSouth Africathat could appeal to Chinese businesses. These include agroprocessing, chemicals, plastics, automotive, capital equipment, steel and aluminium, as well as various services.

Chinais doing more than its fair share to further develop Africaís manufacturing capabilities.ChinaandNigeriaare building one of Africaís largest free trade zones (FTZ) inLagos. Chinese companies will use the facility to manufacture goods for export throughout Africa. The16,000-hectare FTZ aims to develop local manufacturing capabilities and reduce Nigeriaís dependence on imported consumer goods. The FTZ will be well equipped with a deep water port and an international airport to easily transport goods.

While the FTZ will allow Nigerians to buy many of the same products now produced inChinawithout the cost of importing them and create jobs for Nigerian workers, it also gives Chinese companies greater access to growing African markets for consumer goods, electrical equipment, and industrial products. It also allows Chinese companies to ship their Nigerian exports to Europe at more competitive prices.

Meanwhile,Kenyahas its own plan to play a larger role in the China-Africa sphere.Kenyarecently revealed its ambition to host a clearing house for Chinaís yuan currency, a bold vision that would deepen Africaís economic ties withChina.Kenya, East Africaís largest economy, also has one of Africaís most sophisticated financial markets. While Africans can already get quotes for their currencies against the yuan, an official clearing house would cut the need for dollar settlements, speed up transactions and reduce costs. A clearing house will also allow yuan to become a common settlement currency, and be used for official flows such as bilateral loans or aid now denominated in dollars. Overall, African countries must continue to dream big and put themselves in a position to play an increasingly larger role in the global economy or risk getting left behind.

The ChinAfrica Econometer is produced by The Beijing Axis, a China-focused international advisory firm operating in four principal areas: Commodities, Capital, Procurement, and Strategy.

For more information, please contact: Daniel Galvez, danielgalvez@thebeijingaxis.com www.thebeijingaxis.com

|