|

Economy Stays on Target

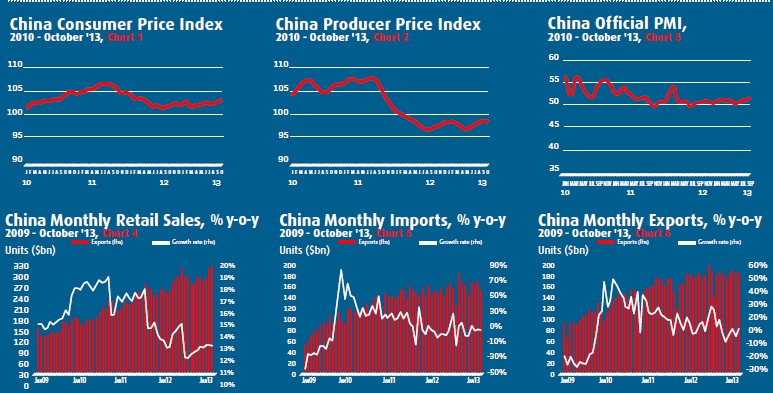

China’s consumer inflation edged higher in October, with the Consumer Price Index (CPI) rising 3.2 percent year on year, its fastest pace in eight months (see Chart 1). The latest reading held within manageable levels, giving policy makers room to focus on maintaining steady growth. The rise was largely due to mounting food prices, with vegetables jumping 31.5 percent. While consumer price inflation is likely to exceed 3 percent in the remaining two months of the year, full-year inflation is expected to come in at around 2.7 percent, well below the government’s target of 3.5 percent. Meanwhile, the Producer Price Index (PPI) fell 1.5 percent, after moderating to a fall of 1.3 percent in September (see Chart 2). October marked the 20th month in a row of falling factory prices, pointing to weakness in demand for raw materials and components from China’s factories.

New economic blueprint

After the conclusion of the Third Plenary Session of the 18th Central Committee of the Communist Party of China (CPC), China pledged to make the most sweeping changes to the economy and the country’s social fabric in nearly three decades with a 60-point reform plan. Overall, the CPC pledged to let the market play a “decisive” role in the economy and outlined changes designed to unleash new sources of growth that it said would yield results by 2020. More specifically, policy makers pledged to open the financial sector and relax curbs on other sectors closed to investors, allow prices of natural resources to reflect market demand and put more money in the pockets of rural residents who were often left out of the boom of the last decade. While some of these reforms will be implemented in the coming months, others will take years to come to fruition.

Manufacturing edges up

China’s official Purchasing Managers’ Index (PMI) for the manufacturing sector edged up slightly to 51.4 in October, an 18-month high (see Chart 3). A PMI reading above 50 indicates an expansion in manufacturing activity from the previous month, whereas a reading below 50 indicates contraction. Pointing to the data, officials acknowledge that growth remains unbalanced and small businesses continue to struggle. October’s reading for big companies rose to 52.3 while the one for small companies fell to 48.5. A surge in lending earlier this year mostly benefited big government-backed firms, which have close relationships with state-owned banks.

Exports lose momentum

Retail sales growth slightly accelerated to 13.3 percent in September, up 0.1 percentage point from September and yet another sign of the growing importance of China’s consumption sector (see Chart 4). China’s exports rebounded sharply in October from a September slump, in a potentially positive sign for the global economic outlook. Import growth remained steady at 7.6 percent in October, slightly faster than September’s 7.4 percent growth rate to reach $154.3 billion (see Chart 5). Exports rose a promising 5.6 percent in October to reach $185.4 billion, a significant improvement after September’s worrisome 0.3 percent decline (see Chart 6). Premier Li Keqiang recently stated that China cannot neglect the importance of its export sector, which supports 30 million jobs directly, hinting policy could be refined in the future to help support the sector.

Alleviating Africa's Employment Challenge

Africaís current population boom means 1 million new jobs are needed each month. Unfortunately, many African countries share the same problem of not being able to create enough jobs for their upwardly mobile youthful populations. While the employment effect of Chinese investment in Africa has always been questioned by international observers, a recently released study hopes to shed some light on this often talked about issue.

Researchers at the Center for Chinese Studies, Stellenbosch University, studied the investment of 16 Chinese enterprises inJohannesburg,South Africa, to analyze their possible employment effects inSouth Africa. Their results found these Chinese investments bring about job opportunities to the local people and alleviate employment pressures, including for many local low-skilled or unskilled laborers. In addition, South Africaís strict labor laws, its powerful labor unions, as well as the international orientation of Chinese enterprises inSouth Africaensure the employment quality of Chinese enterprises often meets the host countryís legal requirements. While the findings conclude that Chinese investment makes an overall positive employment effect, researches also argue that an improvement in the investment environment of South Africa is a prerequisite for further expanding the employment effect of Chinese firms.

The World Bank estimates that the Chinese economy will shed 85 million jobs by 2022 as it moves up the value chain and workers demand higher wages and better living standards. A growing number of Chinese manufacturing companies are assessing Africa as a potential site for low-cost production. Duty-free and tariff-free access to American and European markets through the African Growth and Opportunity Act (AGOA) and Cotonou Agreement remain underexploited incentives to manufacturers.

In 2012,Chinaannounced plans to remove tariffs on 97 percent of items from 30 least developed African countries, and pledged to train 30,000 workers and provide 18,000 scholarships. Repeated affirmations from the Chinese Government of the intention to bolster regional trade, link African products to global supply chains, and improve the variety of imports and the quality of exports reaffirm the increasingly widespread business plans of forward-looking Chinese manufacturers who are painfully experiencing the end of Chinaís demographic dividend.

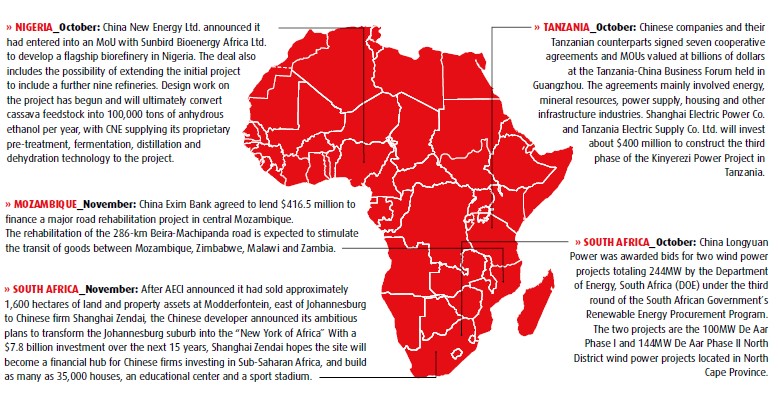

Solutions to Africaís underemployment problem should not be limited to the manufacturing sector. In November, Chinese property developer Shanghai Zendai announced its ambitious plan to turn a suburb outside Johannesburg into the ìNew York of Africa,î with a financial district, 10 hotels, 10 shopping centers and an African culture theme park. According to Chairman Dai Zhikang, Shanghai Zendai will invest $7.8 billion over the next 15 years to develop the area, and will create at least 20,000 jobs. Perhaps even more importantly over the long run, the development will also provide a base for Chinese companies looking to expand into Africa, creating even more employment opportunities.

Africaís labor force is projected to grow to the largest in the world by 2035. African governments must enact bold initiatives to seize their demographic advantage in order to secure stable wage-paying jobs and inclusive economic growth for Africaís populace. into more diversified economies and sustainable growth.

The ChinAfrica Econometer is produced by The Beijing Axis , a China-focused international advisory firm operating in four principal areas: Commodities, Capital, Procurement, and Strategy. For more information, please contact: Daniel Galvez, danielgalvez@thebeijingaxis.com www.thebeijingaxis.com

|