|

Economy Ends Year on High Note

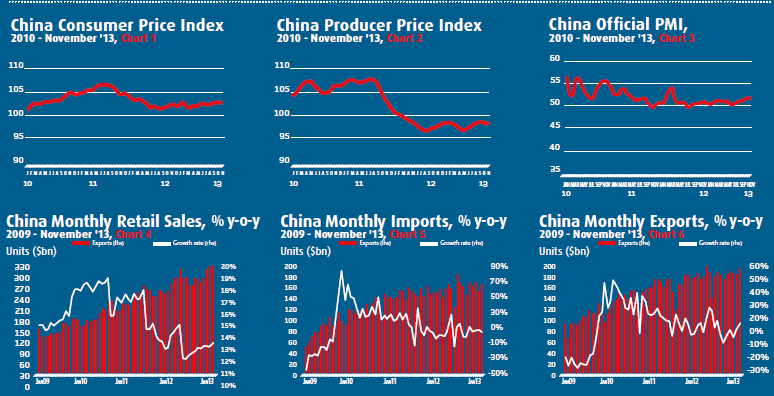

China’s consumer inflation eased slightly in November, with the Consumer Price Index (CPI) up 3 percent year on year, well below the government’s target of 3.5 percent for the year (see Chart 1). Food prices were once again the largest contributor to rising prices, with vegetables up 22.3 percent. Overall, the relatively benign inflation environment has helped policy makers focus more on boosting economic growth. However, China’s ambitious plans to give market forces a greater role in setting prices for resources like oil, natural gas, electricity and water could boost inflation in 2014. Meanwhile, the Producer Price Index (PPI) fell 1.4 percent, slightly less than October’s 1.5 percent drop (see Chart 2). October marked the 21st monthly decline in a row, showing continued weakness in domestic demand for raw materials.

Manufacturing remains steady

China’s official Purchasing Managers’ Index (PMI) for the manufacturing sector held to its 18-month high of 51.4 in November, unchanged from October (see Chart 3). A PMI reading above 50 indicates an expansion in manufacturing activity from the previous month, whereas a reading below 50 indicates contraction. The latest reading helped downplay fears that the economy is losing steam as 2013 draws to a close. The subindex for export orders edged up higher to 50.6 in November from 50.4 in October and can be taken as a small sign that China can press ahead with plans to make way for a more sustainable growth pattern led by consumption rather than investment and exports.

Exports reach new record

Retail sales growth slightly accelerated to 13.7 percent in November, up 0.4 percentage points from October as policy makers look toward consumption to play a bigger role in the economy (see Chart 4). China’s exports continued to exhibit strong growth in November, in a sign that global demand is helping sustain China’s recovery. Import growth remained steady at 5.3 percent in November, slower than October’s 7.6-percent growth rate to reach $168.4 billion (see Chart 5). Exports rose an impressive 12.7 percent in November to reach an all-time high of $202.2 billion, building upon strong momentum in October (see Chart 6). Exports to the United States rose 17.7 percent, the fastest pace since May 2012, while shipments to the EU were up 18.4 percent, the fastest in more than two years. Overall, China’s trade surplus widened in November to $33.8 billion, the largest in more than four years.

Urbanization the key

China’s leaders have recently reaffirmed their intention to turn urbanization into a powerful engine to drive growth and overhaul the economy, by encouraging rural residents to move to smaller cities, rather than Beijing, Shanghai and other megacities. During a two-day session in December, Party leaders made clear that urbanization still ranks high on China’s economic agenda, while showing new determination to elevate environmental concerns and to figure out ways to help local governments pay for the cost of absorbing rural migrants into their future plans. Economists argue rural residents who move permanently to urban areas earn more than they do from their agricultural plots back home and spend more freely, boosting domestic demand. Urbanization also allows agricultural land to be consolidated and farmed more efficiently, ultimately raising productivity and income in rural areas.

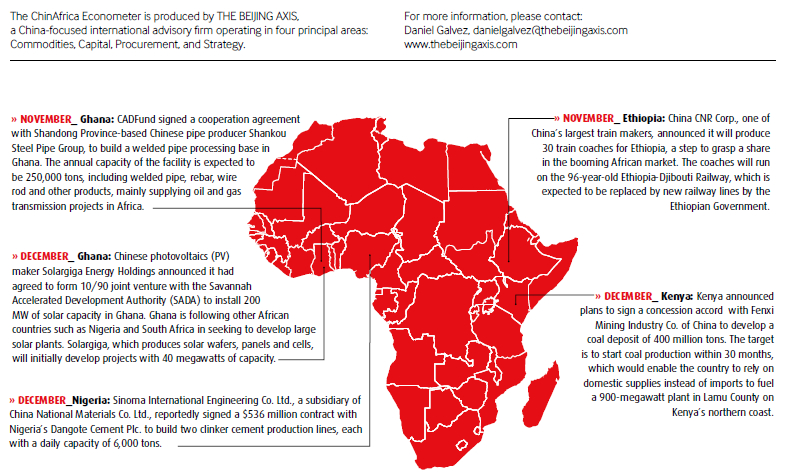

Filling Africa’s Infrastructure Gap

China not only plays an important role in providing funding for infrastructure projects in Africa, but its companies are also taking the lead in constructing the infrastructure so crucial to the continent’s development. Africa’s underdeveloped infrastructure has long been a crucial impediment to its economic development. According to the World Bank, around $93 billion will be required annually to meet Africa’s infrastructure needs until 2020. When the number of resources currently available to African governments is taken into account, an infrastructure funding gap of $31 billion a year exsits, which must be bridged if the continent’s infrastructure needs are to be met.

The problem was compounded in the 1990s when both African and donor investment in infrastructure was scaled back relative to other priorities such as child immunization and education, partly due to the mistaken belief that private investors would step up to fill the gap. As a result, as Africa’s construction sector deteriorated, poor road, rail and harbor infrastructure is adding 30-40 percent to the costs of goods traded among African countries.

It was only in the course of the 2000s that support for African infrastructure began to increase significantly, a process in which China played an important role. According to the Infrastructure Consortium for Africa (ICA), a body (whose members include G8 countries and multilateral institutions such as the World Bank) launched at the Glen Eagles G8 Summit in 2005, total external financial support for African infrastructure reached $37.3 billion in 2007 and $38.4 billion in 2009. Over these three years, contributions by ICA members collectively increased from $12.4 billion to $19.5 billion, while China’s contribution increased from $4.6 billion to $5 billion. While other donors have under-financed infrastructure in Africa, China has devoted around 80 percent of its concessional financing in Africa to this sector.

China is also taking the lead in actually building infrastructure in Africa. According to the Engineering News Report (ENR), in 2001, China’s share of contract revenue in Africa was a mere 7.4 percent, yet by 2011 China’s share had climbed to 40.1 percent, making it the dominant player, far ahead of second-place Italy and third-place France. Indeed, Africa is now China’s largest market in terms of contract revenue with 37.2 percent, even larger than its home market of Asia with 35.9 percent.

|