Lunar New Year Paints Mixed Picture

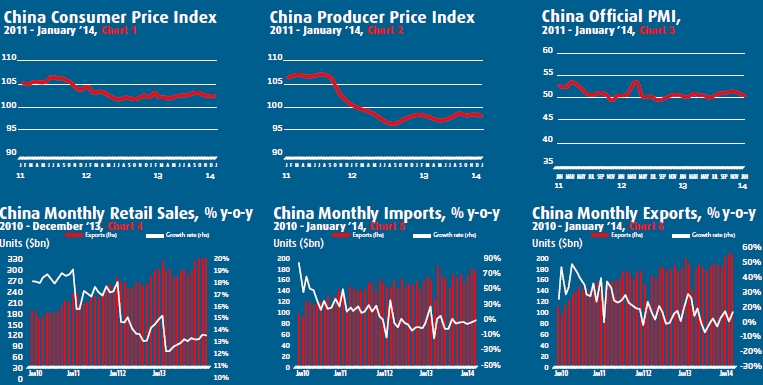

China’s consumer inflation held steady in January, with the Consumer Price Index (CPI) rising 2.5 percent year on year, matching December’s figure (see Chart 1). Overall, China’s inflation rate remained subdued, especially since China’s CPI typically spikes around the Chinese Lunar New Year holiday, which fell at the end of January. The general consensus is that consumer inflation could average more than 3 percent in 2014, as concerns over growing debt overshadow slowing economic growth. Despite a slowing economy and steady price rises, the People’s Bank of China is unlikely to cut interest rates as it remains steadfast in its commitment to slow the growth of credit. Meanwhile, the Producer Price Index (PPI) fell by 1.6 percent after dropping 1.4 percent in December (see Chart 2). January marked the 23rd consecutive month that prices paid for finished goods at the factory gate registered deflation.

Manufacturing activity slows

China’s official Purchasing Managers’ Index (PMI) for the manufacturing sector eased to a six-month low of 50.5 in January, down from 51 in December (see Chart 3). A PMI reading above 50 indicates an expansion in manufacturing activity from the previous month, whereas a reading below 50 indicates contraction. Hindered by weaker local and foreign demand, the figure signals a soft start for the year and reinforces ongoing concerns of a continued economic slowdown in the world’s second-largest economy. Chinese manufacturers continue to struggle with rising interest rates and the appreciating yuan, both of which make China’s exports more expensive in overseas markets.

Trade growth accelerates

In contrast to PMI figures, China’s export growth accelerated in January, which surprised markets given that factories shut down and workers return home during the Lunar New Year holiday. Imports also strengthened more than expected, growing an even 10 percent in January compared with 8.3 percent in December to reach $175.3 billion (see Chart 5). According to China Customs, imports of crude oil, iron ore and copper all hit record highs as Chinese manufacturers sought to take advantage of lower commodity prices to boost their inventory for the year. Exports rose 10.6 percent from a year earlier to reach $207.1 billion in January (see Chart 6). China’s trade surplus, the difference between exports and imports, rose to $31.9 billion in January from $25.6 billion in December. A gradual recovery in Western economies is helping to boost China’s trade, with the Chinese Government expected to target a more subdued export growth of about 7.5 percent in 2014.

Growth target for 2014

In March, China’s leaders will gather in Beijing for the annual legislative session and are expected to announce a target for this year’s growth. Premier Li Keqiang will make his first annual address on China’s economy at the March meeting of China’s parliament, the National People’s Congress. Most analysts will agree the Chinese Government will announce a growth target between 7 percent and 7.5 percent for 2014 following the session.

The Yuan’s Internationalization in Africa

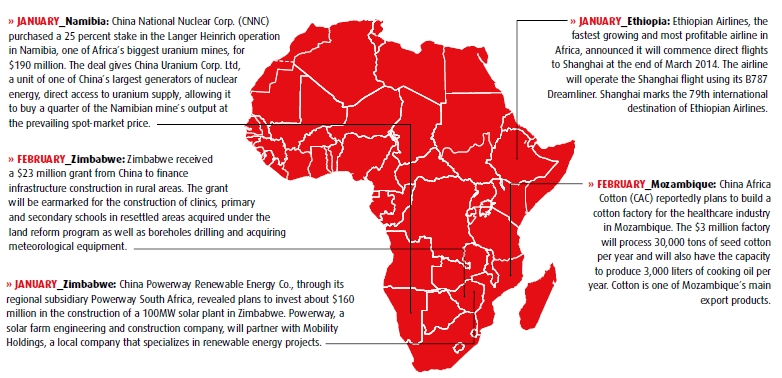

China’s continued economic integration with the African continent has contributed to the yuan’s growing internationalization. Chinese investment in, trade with and aid to Africa have resulted in a growing offshore market for the yuan.

Moreover, Vice Governor of the People’s Bank of China, Li Dongrong, recently confirmed China’s interest in conducting trade and investment deals with African nations in Chinese yuan. African nations, keen on attaining as much Chinese investment as possible, will heed this proclamation. Mauritius, for example, recently imported 5 million yuan ($815,000) through the Bank of China to meet the nation’s growing demand for the Chinese currency.

China’s interest in expanding the use of the Chinese yuan in Africa is motivated by Beijing’s high-level policy of increasing the internationalization of the Chinese currency in order to, among other reasons, reduce the exchange rate risk and exert greater pricing power over commodities.

The level of the yuan’s internationalization rests on the rate at which it is used in international transactions, as a central bank reserve, and for investment purposes.

Recent events in Africa demonstrate the yuan’s increasing use in international transactions. Total trade with Africa has more than doubled from $102.4 billion in 2008 to $210.2 billion in 2013, and China’s trade deficit with the continent has expanded even more rapidly. While only 0.5 percent of China’s deals with the continent were conducted in yuan in 2012, Standard Chartered Bank forecasts roughly 40 percent of China-Africa trade will be conducted in yuan by 2015.

African nations have diversified their national reserves by replacing U.S. dollars with Chinese yuan. Nigeria has led the African continent in this trend. In January 2014, the West African nation pledged to sell roughly $2.15 billion of its reserves of U.S. dollars to replace them with yuan. The nation plans to increase its reserves of Chinese yuan to 10 percent of the central bank’s total reserve. Standard Chartered Bank (China) expects that roughly 20 percent of the total reserves in African countries will be in Chinese yuan by the end of 2018.

China expanded investment opportunities in the yuan in 2007 by creating Hong Kong-based “dim sum bonds.” Though the Chinese yuan investment market is still highly regulated and minimally utilized, South Africa purchased 500 million yuan ($82 million) in dim sum bonds offered by the China Development Bank (CDB) back in 2012, and dim sum bonds will likely become more common in the coming years as they are now being issued at Chinese banks outside of Greater China, such as in London’s ICBC branch.

However, the future of the Chinese yuan’s international convertibility depends on its ability to overcome several challenges - the lack of transparency, perceived corruption, and overregulation in the Chinese financial market and tight capital controls. While some remain sceptical due to the uncertainty of the aforementioned issues, many analysts assert that the yuan will be internationally convertible within the next decade.

The ChinAfrica Econometer is produced by The Beijing Axis , a China-focused international advisory firm operating in four principal areas: Commodities, Capital, Procurement, and Strategy. For more information, please contact: Daniel Galvez, danielgalvez@thebeijingaxis.com www.thebeijingaxis.com