|

REFORMS STABILIZE GROWTH

Beijingannounced that GDP for the first half of 2014 had reached 7.5 percent year on year, barely edging past analyst projections of 7.4 percent. These figures demonstrated that the governmentís reforms, such as the increased spending on infrastructure development and the loosening of fiscal and monetary policy, are successfully stabilizing Chinaís economy. However, challenges to economic growth, such as the countryís massive and largely unregulated shadow banking sector and the nationís festering property market, will continue to obstruct future economic growth.

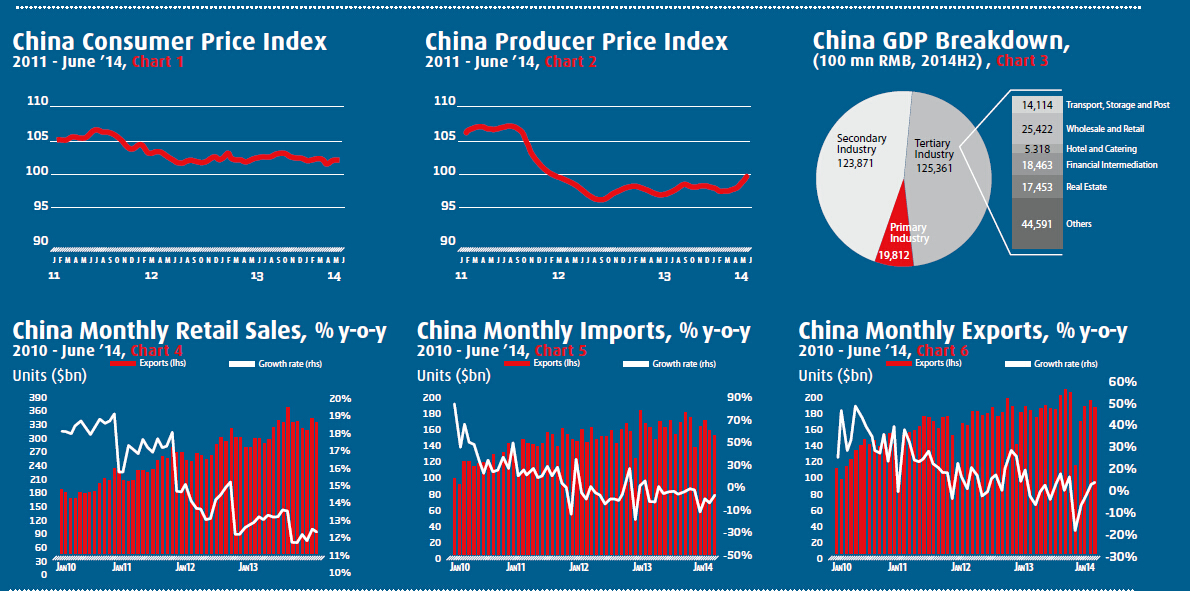

Low inflation

Inflation has remained below the governmentís official projection, which presentsBeijingwith the opportunity to create additional stimulus measures if needed. The consumer price index, a measure of the prices paid for goods and services, actually increased by 2.3 percent year on year in June, compared to Mayís 2.5 percent year-on-year increase. As is common inChina, food prices contributed to a large portion of the increase in CPI - fruit prices, notably, increased by 19.8 percent year on year in June. This low inflation also supports Chinaís goals of increasing consumer spending as it preserves the value of individualsí disposable income.

Dropping producer prices

Another valuable indicator of the demand of Chinaís economy, the producer price index, which measures prices received by producers for their output, fell by 1.1 percent year on year in June, compared to the 1.4 percent year-on-year decrease in May. This drop in producer prices represents the smallest decline since April 2012, another sign of Chinaís low inflation and broader economic stabilization.

Lackluster trade growth

Chinaís trade figures, on the other hand, grew at lower than expected levels. In June, exports increased 7.2 percent year on year, edging past Mayís 7 percent growth, but falling short of forecasts for 10 percent. Imports, however, were a lackluster 5.5 percent year-on-year growth, which resulted in a $31.6 billion trade surplus in June. Fortunately, the increase in Chinaís domestic consumption has proven strong. Demand from Chinaís rapidly growing consumer class has largely replaced potential loss from lower than anticipated foreign demand. Retail sales came in at a 12.4-percent year-on-year increase in June, down slightly from the 12.5-percent increase in May.

Murky monetary movements

In early July, Chinese leaders met withU.S.officials to discuss monetary policy. In what now seems like a well-rehearsed dialogue, U.S. Vice President Joe Biden and Treasury Secretary Jack Lew discussed about the value of the yuan with the Peopleís Bank of China (PBOC) Governor Zhou Xiaochuan, and other counterparts in a two-day strategic dialogue inBeijing. Zhou is recognized as a fiscal reformer, but he must demonstrate the values of greater market valuation before moving forward with anticipated fiscal reform. At a briefing following the dialogue, he stated, ìWhen conditions permit, the PBOC will gradually reduce intervention.

BRICS UNITE FOR DEVELOPMENT BANK

At the opening of the third quarter of 2014, the heads of state of the BRICS nations (Brazil,Russia,India,ChinaandSouth Africa) finalized plans for the New Development Bank, the so-called BRICS bank, and the related Contingency Reserve Agreement.

The New Development Bank will be established with an equal financial commitment from each member for a total authorized capital of $100 billion, $50 million of which is initially subscribed capital. Negotiations had previously stalled asBrazilandIndiaworked against Chinaís attempts to use its larger economic clout to contribute a larger share to the bank, and thus hold greater shareholder rights.

Distributing control of the bank equally amongst its members will be a key priority for the BRICS leaders: the bank will be based inShanghai; the first president will be Indian; and, an African Regional Center will be sited inSouth Africa. Each of the non-chief executive nations will have at least one representative vice president. This bank will focus on funding development projects in emerging economies - both BRICS and other developing economies.

Leaders from emerging economies are unsatisfied with the World Bank and International Monetary Fund (IMF) because the voting rights of these Bretton Woods financial institutions remain concentrated in developed nations. Thus, they hope the BRICS bank can serve as a counterbalance to these institutions by providing loans for infrastructure projects with fewer restrictions and delays. Analysts question, however, if this will result in more projects with poor social and environmental responsibility records.

Further, the World Bank estimates that there is roughly $1 trillion of unfulfilled need for development financing in low- and middle-income countries. The New Development Bank seeks to fulfill a portion of this need and provide an alternative source for financing larger projects when American financial institutions experience reduced funding levels due to market fluctuations.

Although the nations are committing to an equal level of financial commitment for the bank, China demonstrated its heavy financial might with its $41-million commitment to the BRICSí Contingent Reserve Arrangement, which, modeled after the IMF, aims to help the governments of emerging countries with sudden liquidity shortages, such as that experienced after a natural disaster or when investors pull their funds out of a country experiencing financial challenges.Brazil,RussiaandIndiaeach contributed $18 million, while the smallerSouth Africacontributed $5 million.

The BRICS nations, which represent 40 percent of the worldís population and 21 percent of the worldís GDP, are experiencing an economic slowdown. The BRICS financial institutions will move these nations, and other developing nations, toward their goal of reducing dependence on developed nationsí financial institutions to drive economic development, which, if successful, will present a paradigm shift in development finance. |