|

|

|

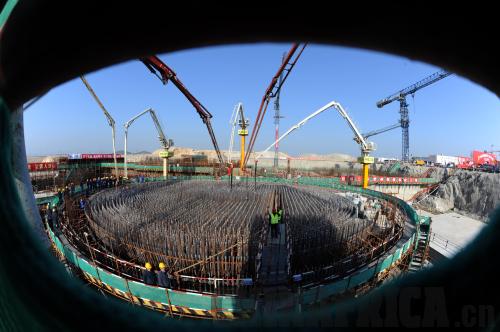

NUCLEAR POWER BOOM: Construction begins at the No.3 generating unit of the CNNC's Fuqing Nuclear Power Plant in southeast coastal Fujian Province on December 31, 2010 (ZHANG GUOJUN) |

As Japan's Fukushima nuclear crisis sparks a global debate over nuclear safety, China National Nuclear Corp. (CNNC), the country's largest nuclear plant operator, comes under the spotlight.

In the wake of the radiation leak at the Japanese nuclear power plant, CNNC ordered immediate safety inspections on its nuclear facilities currently in operation and found all its reactors are running stably without any problems.

"All our reactors are located away from seismic zones and are equipped with improved technologies," said Chen Hua, Assistant General Manager of CNNC. "In addition, design, construction, commissioning and expiration of the plants have been by the book and under the strictest technical standards."

In April 2010, CNNC's self-designed second-generation technology, CP1000, passed expert review, marking a milestone step toward indigenous innovation. Moreover, the company has introduced the cutting-edge third-generation technology AP1000 from the United States and applied it at the Sanmen Nuclear Power Plant under construction in east coastal Zhejiang Province. Both technologies are more advanced and safer than those employed in Japan.

"But it's necessary to learn lessons from Japan's accident and strengthen our own safeguards," said Pan Ziqiang, Director of the Science and Technology Committee of CNNC.

The state-owned nuclear giant now has eight generating units in operation at four nuclear power plants across the country, with a total capacity of 5.82 million kw. The four plants are three phases of Qinshan nuclear power plant in Zhejiang Province and Tianwan nuclear power plant in Jiangsu Province. It also has nuclear power projects under construction in Sanmen and Fangjiashan of Zhejiang Province, Fuqing of Fujian Province and Changjiang of Hainan Province.

In 2010, CNNC's generating units produced 41.1 billion kwh of electricity, accounting for more than 55 percent of the country's total electricity generated from nuclear power.

The company gained more than 6 billion yuan ($913.24 million) in net profits last year, rising 14 percent from a year ago. Revenues from its main businesses totaled 42 billion yuan ($6.5 billion), up 22 percent year on year. Its total assets reached 220 billion yuan ($33.8 billion) at the end of 2010.

The second phase of Qinshan nuclear power plant is CNNC's and also China's first large-scale commercially used pressure water reactor power plant. As it's located in east coastal Zhejiang, the plant basked in the glow of an economic boom in the Yangtze River Delta, raking in 639 million yuan ($97.26 million) of net profits for the first three quarters of 2010.

The nuclear power industry is profitable in part due to a higher on-grid electricity tariff than thermal power, said a recent report by the Shenyin and Wanguo Securities Co. Ltd. Moreover, policymakers handed out generous incentives, including value-added tax rebates for nuclear power plants.

With bullish prospects in sight, CNNC aims for an ambitious goal: By 2015, CNNC wants its main business revenue to top 100 billion yuan ($15.22 billion), its profit to exceed 10 billion yuan ($1.52 billion), and its nuclear power capacity in service to reach 16 million kwß.

In a bid to finance this massive expansion, CNNC is seeking to diversify its financing channels. Earlier this year, CNNC Nuclear Power Co. Ltd., CNNC's wholly owned subsidiary unveiled in April 2010, announced to issue 2 billion yuan ($300 million) five-year promissory notes on February 24, and another 2 billion yuan ($300 million) five-year promissory notes in the second quarter.

On February 12, CNNC and the Industrial and Commercial Bank of China signed the country's first nuclear power project financing lease agreement.

But issuing bonds has higher costs than other financing channels and the current scale financed through bond issuing can't meet the demand of the country's fast-growing nuclear power industry, said Zhou Xiujie, a research fellow with the Shenzhen-based CIC Industry Research Center.

"Getting listing on stock markets is obviously the best solution to the capital bottleneck of domestic nuclear power companies," said Zhou.

Xue Xinmin, a nuclear expert with the Energy Research Institute of the National Development and Reform Commission, also said among various financing methods, going public and issuing stocks should become the first choice for nuclear power companies seeking financing.

"The company is proceeding with share-holding reform and plans to introduce strategic investors before going public," said Chen, who is also General Manager of CNNC Nuclear Power Co. Ltd. Chen was unable to provide a timetable for this action. |